Cannabis Retail Regulation Guide

A guide to the laws, regulations, eligibility requirements and licensing and application process for recreational cannabis retail stores in Ontario.

This guide is provided as a courtesy to potential applicants of retail cannabis licenses and authorizations. Every effort has been made to ensure its accuracy, however, applicants should always consult the relevant legislation, regulations, and standards before proceeding.

How to Use This Guide

This AGCO Cannabis Retail Regulation Guide is a guide to the laws, regulations, eligibility requirements, and licensing and application process for recreational cannabis retail stores in Ontario. This guide is provided as a courtesy to potential applicants of retail cannabis licenses and authorizations. Every effort has been made to ensure its accuracy. However, applicants should always consult the relevant legislation, regulations and standards before proceeding.

- Use the search box (on the left side of your screen) by entering key words like “training” or “fees”

- Click on the headings under the Table of Contents (on the left hand side of your screen) to browse what’s in each section

- Use the links at the bottom of each page to move to the next/previous page in this section or to produce a printer-friendly version of this page

- Look for links on each page to legislation, websites and other helpful resources that provide more information

If you find that this guide is not what you’re looking for, please use the top menu or search box to find other sections of the AGCO website.

Getting Started with iAGCO

iAGCO is the AGCO’s web-based portal through which users can access online services.

The AGCO first launched iAGCO in 2017 and has been rolling out online services for licensees ever since, with horse racing licensees joining iAGCO in March 2020. Given some of the unprecedented challenges experienced in 2020, we recognize that the transition to iAGCO will take time.

This section is intended to provide support for applicants as you use iAGCO online services.

Before getting started in iAGCO

- When using iAGCO online services, it is important to understand that the process of completing your transaction takes time. This includes both the steps you must take and the review and approval process by AGCO staff.

- Please be sure that you have prepared everything you need to complete your submission.

- Do you have the required forms or documents to complete your transaction once you’re logged into the iAGCO portal?

- Some transactions require forms to be signed and uploaded, which you can do before you create your account.

- Once you’ve prepared the required documents, you can begin by creating your iACGO account.

To create your account:

- You will need a valid email address

- You can use any device or browser

- You must provide payment for applicable fees to complete the transaction

- Completing the transaction is not the end of the process. AGCO staff will review your submission and either accept it or get back to you requesting more information.

For more information on iAGCO online services, visit the iAGCO Information page.

Cannabis Retail Regulation in Ontario

Overview of Cannabis Legislation in Ontario

This chapter provides a summary of your cannabis retail requirements under the relevant provincial legislation, including the Cannabis Control Act and the Cannabis Licence Act and the regulations. This is meant to be a guide. It is not a complete list of all rules and is not legal advice. In addition, you may be subject to federal requirements pursuant to the Cannabis Act.

General

To open a retail store and sell recreational cannabis, there are may be two licences and an authorization that are required from the AGCO. These are:

- Retail Operator Licence

- Retail Store Authorization

- Cannabis Retail Manager Licence

All applicants must meet all of the eligibility criteria set out in the Cannabis Licence Act, 2018 and its regulations.

Sole proprietorships or partnerships between individuals may not require a retail manager licence. You should consider the duties performed by individuals to determine if they require a retail manager licence. Please note that the educational requirements must be met.

A cannabis retail store may not sell cannabis unless licensed and authorized by the AGCO, and the retailer must have a supply purchase contract with the Ontario Cannabis Retail Store (OCS). The retailer may only sell cannabis obtained through the OCS..

Retail Operator Licence

To be eligible to open a retail store and sell recreational cannabis, you must have a Retail Operator Licence.

You are not eligible for a Retail Operator Licence if:

- you are under 19 years of age. This includes directors, officers and shareholders of corporations.

- you have been convicted or charged with certain offences:

- any offence under the Cannabis Licence Act

- certain offences under the Cannabis Control Act (CCA) and Cannabis Act (CA)

- you have, or previously had, certain roles or connections with a criminal organization as defined in subsection 467.1(1) of the Criminal Code (Canada):

- you are, or have been a member of the criminal organization

- you are, or have been involved in the criminal organization

- you contribute, or have contributed to, the activities of the organization.

- you are carrying on activities that are not in compliance with certain laws.

- certain offences under the Cannabis Control Act (CCA) and Cannabis Act (CA)

- you have made a false statement or provided false information in your application.

- you are in default of filing a tax return under a tax statute administered and enforced by the government of Ontario, or have any outstanding amounts owing and past due of tax, penalty or interest under those laws and have not made payment arrangements;

- you have a business number with the Canada Revenue Agency and have not filed a tax return under certain Federal or provincial legislation;

- the application will be made by a corporation and more than 25 percent of the corporation is owned or controlled, either directly or indirectly, by one or more licensed producers or their affiliates.

- you will not be financially responsible in operating your cannabis business.

- you will not operate your cannabis retail business in compliance with the law, or with integrity, honesty or in the public interest.

- you will not have sufficient control over the cannabis retail business

-

you had a Retail Store Authorization in the past but the authorization was revoked

Generally, you must wait two years to apply again for a Retail Operator Licence if you:

- applied for a new licence or renewal licence in the past but were refused, or

- you had a Retail Operator Licence in the past but the licence was revoked.

You may have conditions put on your Retail Operator Licence to address any specific risks or concerns. There are also conditions in the Cannabis Licence Act, 2018 that apply to all Retail Operator Licences.

You cannot transfer your Retail Operator Licence to another person or business.

Retail Store Authorization

To open a retail store and sell recreational cannabis, you must have a Retail Store Authorization.

There are some places where you cannot open a cannabis retail store. More information about that is in the next section on Retail Store Location.

Generally, you must wait two years to apply again for a Retail Store Authorization if you:

- applied for a new Retail Store Authorization or renewal of a Retail Store Authorization in the past but were refused, or

- you had a Retail Store Authorization in the past but the authorization was revoked.

You are not eligible for a Retail Store Authorization for a store if:

- you do not have a Retail Operator Licence now, or would not have a Retail Operator Licence at the time when the Retail Store Authorization would be issued.

- you have a Retail Operator Licence that has conditions that do not allow you to apply for or receive a Retail Store Authorization for that store.

- you have been convicted of or charged with certain offences:

- any offence under the Cannabis Licence Act

- certain offences under the Cannabis Control Act, 2017 and Cannabis Act (Canada) or their regulations

- you have, or previously had, certain roles or connections with a criminal organization as defined in subsection 467.1(1) of the Criminal Code (Canada):

- you are, or have been a member of the criminal organization

- you are, or have been involved in the criminal organization

- you contribute, or have contributed to, the activities of the organization.

- you are carrying on activities that are not in compliance with certain with certain laws.

- Certain offences under the Cannabis Control Act (CCA) and Cannabis Act (CA)

- you hire or plan to hire someone who does not have a Cannabis Retail Manager Licence, but should have that Licence because of the work they do

- it is not in the public interest, based on the needs and wishes of the people who live in the municipality where the proposed store would be located.

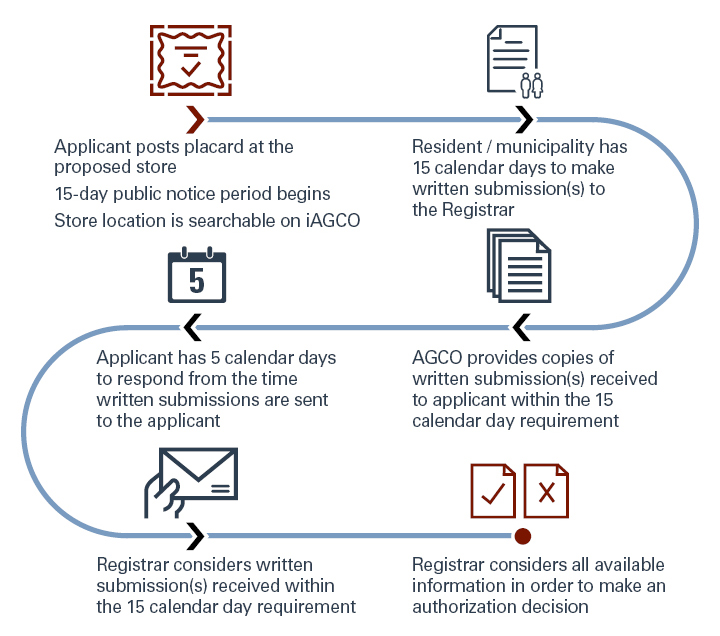

- After you apply for a Retail Store Authorization, the Registrar will inform local residents and the municipality about the application by having a notice posted at the proposed store and on the AGCO’s website.

- The municipality or local residents submit written submissions to the Registrar about whether the proposed store is in the public interest, as set out in regulation. The submissions must be sent within 15 calendar days after the notice is posted.

- Relevant submissions are limited to the following matters of public interest:

- protecting public health & safety;

- protecting youth and restricting their access to cannabis;

- preventing illicit activities in relation to cannabis.

- the store, equipment and facilities do not comply with the Cannabis Licence Act, 2018, regulations, the Registrar’s Standards or requirements

- you do not have sufficient control over the store, equipment and facilities

- you have made a false statement or provided false information in your application

A Licensed Producer and its affiliates are eligible to apply for a single RSA. The proposed cannabis retail store must be located on or within the site set out in the federally issued production licence.

You may have conditions put on your Retail Store Authorization to address any specific risks or concerns. There are also conditions in the Cannabis Licence Act, 2018 and regulation that apply to all Retail Store Authorizations.

You cannot transfer your Retail Store Authorization to another person or business.

Retail Manager Licence

Every cannabis retail store must have a licensed retail manager. People who perform certain duties within the cannabis retail store must get a Cannabis Retail Manager Licence. This includes people who:

- supervise, manage or hire employees of the store

- manage the sale of cannabis

- manage compliance issues relating to the sale of cannabis

- buy cannabis for the store

- enter into contracts for the store.

The only people that can perform the duties listed above are people with a Cannabis Retail Manager Licence or a Retail Operator Licence.

You are not eligible for a Cannabis Retail Manager Licence if:

- you are under 19 years of age

- as a licensed retail manager, you will not act in compliance with the law, or with integrity, honesty or in the public interest

- you have been convicted or charged with certain offences:

- any offence under the Cannabis Licence Act

- certain offences under the Cannabis Control Act (CCA) and Cannabis Act (CA)

- you have, or previously had, certain roles or connections with a criminal organization as defined in subsection 467.1(1) of the Criminal Code (Canada):

- you are, or have been a member of the criminal organization

- you are, or have been involved in the criminal organization

- you contribute, or have contributed to, the activities of the organization.

- you are carrying on activities that are not in compliance with certain laws.

- certain offences under the Cannabis Control Act (CCA) and Cannabis Act (CA)

- you have made a false statement or provided false information in your application

Generally, you must wait 2 years to apply again for a Cannabis Retail Manager Licence if you:

- applied for a new Cannabis Retail Manager Licence or renewal Cannabis Retail Manager Licence in the past but were refused, or

- you had a Cannabis Retail Manager Licence in the past but the licence was revoked.

You may have conditions put on your Cannabis Retail Manager Licence to address any specific risks or concerns. There are also conditions in the Cannabis Licence Act that apply to all Cannabis Retail Manager Licences.

You cannot transfer your Cannabis Retail Manager Licence to another individual.

Retail Store Location

Municipalities:

Ontario municipalities had a one-time option to opt out of having cannabis retail stores in their communities. They had until January 22, 2019 to notify the AGCO that their council had passed a resolution to opt out of having cannabis retail stores. Municipalities that choose to opt out can opt back in at any time—but once they have opted in, they may not reverse their decision.

Cannabis retail stores cannot be located in a municipality that has passed a resolution prohibiting cannabis retail stores from being located in the municipality.

- The AGCO’s website has a list of municipalities that have decided not to allow cannabis retail stores.

- Municipalities that have opted-in may not create a licensing system respecting the sale of cannabis nor pass a bylaw that distinguishes land or building use for cannabis from any other kinds of use.

Near Schools:

Things to Know Before You Begin:

As an applicant, it is your responsibility to ensure your proposed retail store location meets school proximity requirements at all times throughout the entire application process.

The use of iAGCO to check the eligibility of a potential retail location is not advice and does not function as a substitute for an applicant’s continued due diligence.

The submission of your application does not guarantee approval. The determination that an RSA application satisfies all retail location requirements is made based on information available at the time of issuance of the RSA and not at the time of submission of the application through iAGCO.

Please note that changes to an applicant’s proposed location requires submission of a new application. Application fees are non-refundable.

The Registrar cannot issue an RSA to a proposed cannabis retail store located less than 150 metres from a school or private school, as defined in the Education Act. This will be determined as follows:

- When the school or private school is the primary or only occupant of a building, 150 metres shall be measured from the property line of the property on which the school or private school is located.

- When the school or private school is not the primary or only occupant of a building, 150 meters shall be measured from the boundary of any space occupied by the school or private school within the building.

The distance between a proposed retail store and a school or private school is measured by a straight line from the closest point of the school property or boundary as described above to the closest point of the proposed retail store.

If either the store and/or the school is located on a floor other than the ground floor or main level in its respective building, the measure of the 150 metre distance may take into vertical distance in assessing compliance with this requirement.

The above rules do not apply if the private school is located on a reserve or if the private school only offers classes through the Internet.

Online submission of the application is not a guarantee or confirmation that the proposed location is compliant with the school proximity restriction. The proposed retail location must be in compliance with the school proximity requirement at the time the RSA is issued.

Retail Store Requirements

There must be separation between your cannabis business and other businesses. If an existing retail space is renovated to create two or more spaces, the space that is intended to be a cannabis retail store must adhere to the listed criteria below and all the eligibility requirements set out in the Cannabis Licence Act, 2018 and regulation.

The retail space where you will sell cannabis:

- must be enclosed by walls separating it from any other commercial establishment or activity

- does not include an outdoor area

- cannot be entered from or passed through in order to access any other commercial establishment or activity, other than a common area of an enclosed shopping mall.

In addition, the area where cannabis will be received or stored cannot be accessible by any other business or by the public. This does not mean that an establishment is required to have a separate door for product receipt. For example, if a premises has only one door, product could be received through this door outside of business hours, or access to the door could be restricted by security personnel at the time of product delivery.

Background Checks

As part of its review of your application for a new licence or authorization, or renewal licence or authorization, the AGCO may do background checks and investigations on applicants, and any affiliated or interested parties in the business, as needed. The AGCO may look at the character, financial history and competence of persons applying for a licence or authorization. You may be required to pay some of the costs of the background checks or investigations.

Training

In Ontario, anyone who works in a cannabis retail store must successfully complete an AGCO Board approved cannabis retail employee training program before their first day of work to support the safe sale and consumption of cannabis. This includes:

- holders of a Retail Store Authorization

- holders of a Cannabis Retail Manager Licence

- employees of a cannabis retail store

Operating a Store

There are rules you must follow when operating your store.

You must:

- begin selling cannabis at your authorized store within one year of getting your Retail Store Authorization, and continue to sell cannabis

- open only during permissible hours: between 9:00 a.m. and 11:00 p.m. on any day

- display the official cannabis retail seal. You must post the seal in a place where people can easily see it from outside the entrance to the store. The seal must be at least 17 centimetres wide and 20 centimetres long. You can chose to post the French version of the seal, or the English version, or both.

- remove the seal as soon as possible if your Retail Store Authorization is revoked or not renewed

- post your Retail Store Authorization in the store in a place where people can easily see it

- only sell cannabis that has been made by someone who is authorized under the Cannabis Act (Canada) to make cannabis for commercial purposes

- keep records of specified information and activities

- have measures in place to reduce the risk that your cannabis will be redirected to the illegal market or illegal activities

- record all sales

- make information about the responsible use of cannabis available to patrons

- ensure that all licensed managers and other employees working in your store successfully complete the required Board approved training program prior to their first day of work at the store.

- request identification of anyone who looks under 25 years old and be satisfied the person is at least 19 years of age prior to allowing them to enter the store.

You must not:

- sell cannabis or cannabis accessories to anyone who is under 19 years old

- allow anyone who looks under 25 years old to enter the store, unless you first request identification and are satisfied the person is at least 19 years of age

- sell cannabis to anyone who is intoxicated or looks intoxicated

- sell more than 30 grams of dried cannabis (or equivalent amount of another kind) to a person in a single visit

- hire anyone who is under 19 years of age.

You cannot sell cannabis or cannabis accessories from a display that allows self-service, or from a vending machine.

You must display your cannabis and accessories in a way that they cannot be seen by a young person, even from outside the store.

Delivery and Curbside Pick-up

Authorized cannabis retail stores are permitted to offer delivery and curbside pick-up services

Note: Cannabis retail stores are not permitted to operate entirely or predominantly as delivery businesses.

Requirements for Delivery

- Delivery can only be done by the Retail Store Authorization (RSA) holder or their employees. Third party delivery is not permitted.

- Deliveries can only be made to a residence or private place in Ontario (for instance, a hotel room would be considered a private place).

- Deliveries can only be made to a person who is at least 19 years old. If the person appears to be under 25 years of age, the authorization holder or employee completing the delivery must require the person to provide identification and must be satisfied that the person is at least 19 years old.

- Delivery must be at the address specified in the order.

- Records of deliveries must be maintained.

- Delivery orders must be placed with a specific store location.

- Delivery orders must originate and be fulfilled from that same store with products that are stored on-premises.

- Cannabis cannot be removed from the store for delivery unless an order has been received.

- If cannabis is removed from the store for delivery but the delivery is not completed, the cannabis must be returned to the same store from which the delivery originated on the same day, and it must remain there until the next day on which delivery is attempted.

- Cannabis may only be delivered at a time when the physical cannabis retail store is open to the public.

- If the store is in a premises whose owner or landlord requires it to be closed to the public during the permitted hours of operation, the store may still complete deliveries between 9:00 a.m. and 11:00 p.m. Examples of such a scenario include retail stores located within malls. However, a store cannot deliver if the landlord or owner requires it to be closed and is an interested person in the holder of the Retail Store Authorization (RSA).

Requirements for Curbside Pick-Up

- Curbside pick-up transactions can only be completed by a RSA holder or employee and must be completed in an area adjacent to the store that is captured by the store’s surveillance system.

Delivery Requirements to First Nations Communities

- Delivery to First Nations communities is permitted unless the community has requested delivery be restricted.

- First Nations band councils wishing to restrict delivery to their community can submit a band council resolution to the AGCO. The AGCO will notify all authorized retail stores when a band council resolution is received and the restriction would come into effect 30 days after such notice is provided, after which point any delivery to the First Nations community would not be permitted.

Requirements for Store Websites, Apps or other Similar Online Platforms

- For websites, apps or other similar online platforms used for the purposes of the cannabis retail store, licensees must take reasonable measures to ensure that customers accessing them are at least 19 years of age.

- Licensees must display the official Ontario cannabis retail seal and make available the applicable RSA information (the authorization number, the holder’s name, the store’s operating name and the store address) on websites, apps or other similar online platforms.

Renewing your Licence or Authorization

You must apply to renew your licence or authorization before the current term expires.

As a courtesy, the AGCO will send a renewal reminder sixty (60) days prior to the expiration date of a licence and an additional reminder seven (7) days prior to expiration if the renewal application has not yet been submitted.

If your renewal application and applicable fee(s) are submitted on or before the expiry date, your licence and/or authorization will be deemed to continue until your licence and/or authorization is renewed.

If your renewal application and applicable fee(s) are not submitted before the expiry date on your licence and/or authorization, it will expire and cannot be renewed.

How to submit a renewal application:

To begin your renewal application, log into your iAGCO account and click the “Renew” button next to the applicable licence/authorization.

Please note: The “Renewal In Progress” status on your iAGCO account is not confirmation that the renewal application has been submitted; it could mean that someone started a draft renewal but has not paid the fees nor submitted the application. You are encouraged to use measures to confirm that renewal applications are submitted, such as keeping iAGCO Application Confirmation emails or Application Summaries. If you have shared your access code with others and/or have previously permitted others to submit applications on your behalf, notify the AGCO in writing when that permission is revoked.

Effect of non-renewal of Retail Manager Licences

If your Retail Manager Licence expires, you cannot perform any of the functions under subsection 5(1) of the Cannabis Licence Act.

Licensed Operators are responsible for ensuring that anyone performing the functions under subsection 5(1) of the Cannabis Licence Act hold an active Retail Manager Licence.

-

The status of AGCO-issued licences can be searched online via iAGCO

-

QR codes on the licence can be scanned to confirm authenticity and/or to confirm the licence status

Effect of non-renewal of Retail Operator Licences

Subsection 12(1) of the Cannabis Licence Act indicates that if a holder’s Retail Operator Licence is revoked or fails to be renewed, any Retail Store Authorizations held by the holder are revoked from the time of the Retail Operator Licence revocation or non-renewal.

Effect of non-renewal of Retail Store Authorizations

Subsection 12(3) of the Cannabis Licence Act indicates that if a Retail Store Authorization is revoked or fails to be renewed and the Registrar considers it appropriate in the circumstances to do so, the Registrar may, without issuing a proposal, revoke or suspend:

-

Any other Retail Store Authorization held by the same holder;

-

The holder’s Retail Operator Licence; or

-

Both.

You must cease operation of any retail stores where a Retail Store Authorization has expired or has been suspended or revoked. You are prohibited under the Cannabis Control Act, 2017 from selling or distributing cannabis.

There are penalties for offences related to unauthorized sale or distribution, false representation as an authorized cannabis retailer, etc. under the Cannabis Act, Cannabis Control Act, 2017, and/or the Cannabis Licence Act, 2018. You are reminded of your obligations to comply with all laws and regulations and of your responsibility to renew on time.

If you no longer require your Cannabis Licence(s) and/or Authorization(s), more information on requests to cancel can be found at: Cannabis Retail Regulation Guide: Modifications to Existing Licences / Authorizations

Cannabis Retail - Conditions

As part of the AGCO’s risk-based licensing approach, one or more conditions may be attached to a Cannabis Retail Operator Licence, Retail Manager Licence and/or Retail Store Authorization by the Registrar to help the licensee minimize risks identified during the assessment process. Below is a complete list of the conditions the Registrar may impose, as approved by the AGCO Board of Directors:

|

# |

Condition |

|---|---|

|

Honesty, Integrity and Financial Responsibility |

|

|

1 |

The holder of the licence and/or authorization shall notify the Registrar in writing within five (5) business days of entering into any agreement with respect to changes in ownership, control or affiliations of the licence holder or authorized store and provide proof that the agreement complies with all regulatory requirements and/or the lottery rules. |

|

2 |

A licensed retail manager or the licensed operator must be onsite at the authorized store at all times while the authorized store is open. |

|

3 |

The holder of the licence and/or authorization shall have a written code of conduct for employees and provide proof that employees have read and understand the requirements. |

|

4 |

The holder of the licence and/or authorization must notify the Registrar in writing within five (5) business days of any new source of funds used to support operations of the holder of the licence and/or the authorization or operations of the authorized store. |

|

5 |

A licensed retail manager must perform the following duties at the store: (DUTIES) |

|

Minors |

|

|

6 |

The holder of the licence and/or authorization shall ensure that the identification of every individual who appears to be under the age of 25 years is inspected at entrance(s) to the authorized store and at the point(s) of sale. |

|

Safety and Security |

|

|

7 |

The holder of the licence and/or authorization shall maintain a log confirming the security camera equipment is functioning at all times. The logs shall be made available for inspection and review upon request by the AGCO. |

|

8 |

The holder of the licence and/or authorization shall retain all surveillance recordings for at least XXX day(s). |

|

9 |

The holder of the licence and/or authorization shall ensure that there is a sufficient number of licensed and visibly identifiable security personnel at all times while the authorized store is open. |

|

10 |

The authorized store shall be staffed with at least XX (number of) licensed and visibly identifiable security guard(s) from XX:XX (am/pm) until closing. |

|

11 |

The authorized store must be equipped with a working monitored alarm system to detect and log attempted unauthorized access to and unauthorized movement within the authorized store premises. |

|

12 |

The holder of the licence and/or retail store authorization shall ensure that measures are in place to prevent and address disorderly conduct on the authorized store premises, property adjacent to and in the vicinity of the premises by persons either waiting to enter or persons exiting the premises. |

|

Prohibited Person(s) |

|

|

13 |

The holder of the licence and/or authorization shall ensure that the following individual(s) is/are not permitted to enter or be at the authorized store: (NAMES) |

|

14 |

The holder of the licence and/or authorization shall ensure the following persons have no involvement in the business operations of the authorized store, including as an officer, director, shareholder or owner and/or have no involvement or beneficial or financial interest in the business or ongoing operations of the licence: (NAME(S) |

|

15 |

The holder of the licence and/or authorization shall ensure that the following individual(s) is/are not permitted in the authorized store except to perform duties arising from his/her position as landlord or sub-landlord in accordance with the following terms: (NAME(S) (TERM (S) |

|

16 |

The holder of the licence and/or authorization shall ensure that the following individual(s) is/are not involved directly or indirectly in the operation and financing of the business: |

|

17 |

The holder of the licence and/or authorization shall not employ the following individual (s) in any capacity: (NAME(S) |

|

Product Security and Record-Keeping |

|

|

18 |

The holder of the licence and/or authorization must ensure that physical inventory counts are carried out on a daily basis for each day that the authorized store is open, that a log is kept, and any discrepancies are reported in writing to the AGCO within 24 hours. |

|

19 |

The holder of the licence and/or authorization must submit in writing a report to the AGCO on a biweekly/weekly basis of all inventory movements of cannabis products. |

|

20 |

The holder of the licence and/or authorization shall ensure that all employees are subject to screening for stolen product before exiting the authorized store. |

|

21 |

The holder of the licence may not transport cannabis between their authorized store locations. |

|

22 |

The holder of the licence and/or authorization must notify the AGCO in writing within 72 hours in advance of destroying any cannabis. |

|

23 |

The holder of the licence and/or authorization must ensure that after operating hours, all cannabis is locked in a secure storage room accessible only by authorized staff. |

|

24 |

The holder of the licence and/or authorization must maintain a list of employees that are authorized to access the secure cannabis storage room. |

|

25 |

The secure cannabis storage room may not be used for any other purpose other than the storage of cannabis. |

|

26 |

The holder of the licence and/or authorization must ensure that sensory display containers are physically tethered or affixed to a secure surface. |

|

27 |

The holder of the licence and/or authorization may not use sensory display containers in the authorized store. |

|

28 |

The holder of the licence and/or authorization must ensure that patrons do not handle any cannabis until it is purchased. |

|

Compliance Plans |

|

|

29 |

The holder of the licence and/or authorization (applicant) shall submit by (DATE) a proposed compliance plan to the Registrar for review and filing that addresses the objectives identified by the Registrar, including but not limited to the following issues: (ISSUE TYPES) |

|

30 |

The holder of the licence and/or authorization (applicant) shall submit by (DATE) a proposed compliance plan to the Registrar for review and approval that addresses the objectives identified by the Registrar, including but not limited to the following issues: (ISSUE TYPES) |

|

31 |

The holder of the licence and/or authorization (applicant) shall comply with the compliance plan filed with the Registrar. |

|

32 |

The holder of the licence and/or authorization (applicant) shall comply with the compliance plan approved by the Registrar. |

|

33 |

The holder of the licence and/or authorization shall keep the compliance plan onsite at their authorized store(s) and make it available to AGCO upon request. |

Cannabis Retail - Plans

As part of the AGCO’s risk-based licensing approach, the Registrar may require that a licensee prepare one or more plans to address areas of risk identified during the assessment process. Below is the type of plan the Registrar may require, as approved by the AGCO Board of Directors:

Compliance Plan

A plan designed to ensure that the authorized store is operating in compliance with the overall cannabis retail regulatory regime in place in Ontario, helping to protect the public-at-large, as well as the licensee, from potential harm caused when regulations are not followed. The plan must identify best practices, policies and other requirements that the licensee will adopt in order to achieve specific and general compliance goals, with a primary focus on the regulatory requirements that are specific to retail cannabis licensees.

This includes reasonably addressing issues such as record-keeping and inventory management, safety and security, management structure and policies, preventing access by minors, preventing illicit activity, the type of products available for sale, staff training, store policies, internal control issues, and other general compliance issues.

Cannabis Retail - Modifications to Existing Licences/Authorizations and/or Changes to Information

Removing a Condition on a Cannabis Licence/Authorization

If you have a condition(s) on your cannabis Retail Operator Licence, Retail Manager Licence and/or Retail Store Authorization, and circumstances have changed, you may apply to have a condition removed. Depending on the manner in which the condition was added to your licence and/or authorization you will be required to apply to either the AGCO or the Licence Appeal Tribunal (LAT).

You may apply to the AGCO’s Registrar to have a condition on your licence and/or authorization removed if:

-

The condition was imposed on a licence/authorization by the Registrar with your consent pursuant to the Cannabis Licence Act.

-

The condition was imposed on the licence/authorization by the Registrar as part of the AGCO’s risk-based licensing process. Risk-based licensing conditions can only be removed if the Registrar determines that the risk designation is no longer necessary.

Please note that the Registrar will only consider removing a condition if the circumstances that required it have changed and it is deemed to no longer be necessary. To request a removal of conditions, you must log into iAGCO, select “Request a Change”, select the appropriate licence and/or authorization and select “Removal of Condition(s) on Consent” to submit all relevant information and supporting documentation.

You may apply to the LAT to have a condition on your licence and/or authorization removed if:

-

The condition was imposed by a panel of the LAT after a hearing

In this case, you must consult the LAT website for the applicable forms and process.

Changing Legal Entity Type

Cannabis licences and/or authorizations are non-transferable. If you are the holder of a Cannabis Retail Operator Licence and/or Cannabis Retail Store Authorization and would like to change your legal entity type (for example, sole proprietor to a corporation) you must submit a new application and applicable fees.

Change Operator at Existing Authorized Store

Cannabis licences and/or authorizations are non-transferable. If a new operator intends to take over an existing authorized store from the existing licensee, a new retail store authorization application and applicable fees must be submitted.

If there is cannabis inventory already onsite at the authorized retail store, the existing licensee and the applicant must reach an agreement regarding the inventory. If the applicant does not wish to take on the cannabis inventory the licensee must determine what to do with inventory.

Corporate Structure Changes

To notify the AGCO of corporate structure changes as outlined in the Registrar’s Standards, you must log into iAGCO, select “Request a Change”, select the appropriate Cannabis Retail Operator Licence and select “Corporate Structure Update” to submit all relevant information and supporting documentation, including disclosure.

Documentation confirming the transactions are completed will be required before changes can be approved.

New Sources of Funding and/or Agreements

The holder of a cannabis retail operator licence is required to notify the Registrar within five (5) business days of entering into any agreements or of any new sources of funds used to support the operations of their cannabis business.

To disclose third party agreements or new sources of funds, you must log into iAGCO, select “Request a Change”, select the appropriate Cannabis Retail Operator Licence and select “New and/or Changes to Agreements or Sources of Funds” to submit all relevant information and supporting documentation.

Adding and/or Changing Names

Licensees are reminded that their store’s operating name must match what is set out on the Retail Store Authorization per the Registrar’s Standards.

If the licensee is a corporation, partnership or sole proprietorship, its business trade (operating) name may have to be registered under the Business Names Act. For information and forms, please see the Ontario.ca Central Forms Repository. Forms must be forwarded to the Companies and Personal Property Security Branch for processing.

Note:

-

Licensed Retail Managers changing their legal name should submit this change in relation to their Retail Manager Licence.

-

Licensed Retail Operators changing the name of the legal entity should submit this change in relation to their Retail Operator Licence and any Cannabis Retail Store Authorizations they hold.

-

Licensed Retail Operators changing the operating name of their store should submit this change in relation to their Cannabis Retail Store Authorization.

To request name change, you must log into iAGCO, select “Request a Change”, select the appropriate licence and/or authorization and select “Adding and/or Changing Names” to submit all relevant information and supporting documentation.

Request to Cancel a Licence and/or Authorization

The Registrar may cancel a licence or authorization if the holder makes a request to the Registrar in writing and surrenders the licence or authorization.

If you are a licensed operator permanently closing an authorized store, in addition to notifying the AGCO of the permanent closure through the notification matrix, you must also submit a separate request to cancel your authorization.

To request a cancellation of your licence and/or authorization, you must log into iAGCO, select “Request a Change”, select the appropriate licence or authorization and select “Request to Cancel” to submit the request and to provide the required documentation.

Note:

-

If the holder of both a Cannabis Retail Operator Licence and Cannabis Retail Store Authorization(s) wants to cancel their Retail Operator Licence, they must submit a request to cancel and surrender each Retail Store Authorization to the Registrar together with the Retail Operator Licence.

-

Operators must comply with the requirements specified by the Registrar respecting any cannabis left unsold or undistributed as a result of the cancellation and ensure that final reporting obligations are completed.

-

If the licensee is a corporation, a Board Resolution confirming the decision to cancel may be required.

Cannabis Retail Operator Licence, Retail Store Authorization and Cannabis Retail Manager Licence - Risk-Based Licensing

The AGCO employs a risk-based approach when issuing and regulating Cannabis Retail Operator Licences, Cannabis Retail Manager Licences, and Cannabis Retail Store Authorizations. Risk-based licensing allows the AGCO to encourage good business practices throughout the industry and to focus its own regulatory resources where they will make the most difference.

Although there is always some risk attached to the sale of recreational cannabis, the AGCO recognizes that due to variables (such as location, past history and experience), some establishments and individuals pose a greater risk to the public interest and/or to non-compliance with the law. Risk-based licensing is one of several initiatives the AGCO has implemented in the other sectors it regulates. This approach to licensing allows AGCO to base its decisions on risk assessments and its approach to regulation on encouraging compliance rather than relying solely on enforcement following any violations.

Risk-based licensing assists Cannabis Retail Operator licensees, Cannabis Retail Manager licensees and Cannabis Retail Store Authorization holders in operating their establishments in a safe, responsible, and compliant way.

The authority to carry out a risk-based licensing regime is given to the AGCO under Section 6 (5) of the Cannabis Licence Act, 2018.

How Risk-Based Licensing Works

There are four key principles behind risk-based licensing:

- To identify persons or places that pose specific risks to the public interest;

- To lessen risks and ensure compliance with the Cannabis Licence Act, 2018, and its regulations, and the Registrar’s Standards for Cannabis Retail Stores through the entire lifecycle of a licence;

- To reduce the administrative burden for those who pose a lower risk, where possible; and

- To focus more AGCO resources on those cannabis retail stores that pose enhanced risks.

The application of risk-based licensing can occur at any point in the lifecycle of a Cannabis Retail Operator licence, Cannabis Retail Manager licence, and Cannabis Retail Store Authorizations.

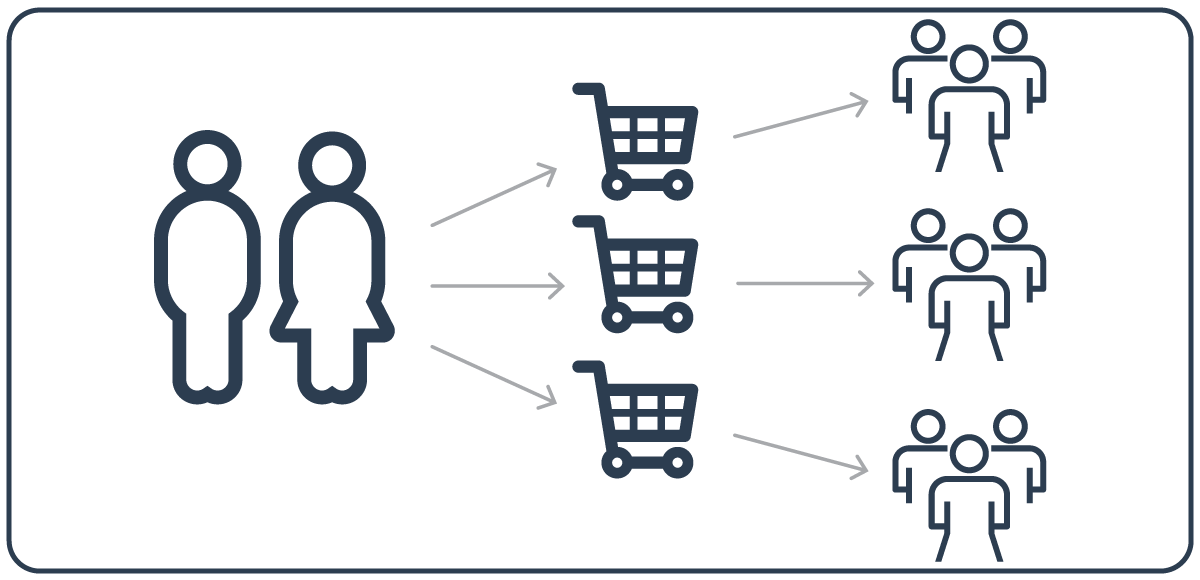

New applicants proceed through a three step process:

- After an application, for a licence or authorization, is received, an eligibility assessment process takes place. During the initial application or authorization review, the Registrar uses specific criteria to assess the risk(s) posed to the public interest, and of non-compliance with the law.

- After reviewing all the available information on the licensee/applicant, the Registrar assesses the risks and determines if the licence should proceed to an enhanced review.

- If the Registrar believes that no conditions need to be placed on a licence, or if a licensee has taken steps on their own to recognize and manage any risks, then these establishments will see no change in the way that their licences are administered.

- If the Registrar believes that a licensee may need more assistance and support to remain compliant with the Cannabis Licence Act, 2018, following the eligibility assessment review, then conditions may be placed on the licence, and/or more AGCO resources will be focused on the licensee in order to mitigate any risks.

Applicants renewing their licence or authorization, or having a condition on their licence, would only proceed through steps 2 and 3.

During the lifetime of a licence or authorization, the Registrar can reassess the risk posed by the licensee. This reassessment can occur either because the licensee requests a reassessment, or because the Registrar becomes aware that there has been a change in circumstances and there should be a reassessment. At each of these times the Registrar may add, remove or amend one or more conditions.

Suspension or Revocation of Licences & Authorizations

All owners/operators of cannabis retail stores along with store managers are subject to the provincial Cannabis Licence Act, 2018, its regulations and the Registrar’s Standards.

If you do not comply with legislation and regulations or are no longer eligible for your licence or authorization, your licence or authorization may be suspended or revoked. You will be advised of the licence or authorization being suspended or revoked and can request a hearing before the Licence Appeal Tribunal.

In some cases, depending on the reasons, the licence or authorization may be suspended or revoked immediately.

If your Retail Store Authorization is suspended, you must post a sign about the suspension in a place where people can easily see it from outside the store.

If your Retail Store Authorization is revoked, suspended or cancelled, you must comply with any rules set by the Registrar regarding the disposal of cannabis that has not been sold or distributed.

Inspectors

AGCO Inspectors may visit the retail store location to confirm compliance with the Cannabis Licence Act, 2018 and regulations. You must allow the inspection, and you must not interfere with the inspector, refuse to answer questions related to the inspection, or provide false information.

When doing an inspection, an AGCO Inspector may:

- ask you for and look at certain records that are relevant to the inspection

- take certain records away from the store to review, examine, test or copy. In this case, the Inspector will give you a receipt confirming which records have been taken.

- After the inspector has taken the records, you can request that the records be made available to you.

- The records will be returned to you in a reasonable time, unless the records cannot be returned because of the testing done.

- take photographs or other recordings

- ask about financial transactions, records or other matters relevant to the inspection.

If an inspector asks you for a record, you must provide it. You must also must help the inspector understand the record or provide it in a readable form.

Inducements

If you have a Retail Operator Licence, a Retail Store Authorization and/or a Cannabis Retail Manager Licence, no one is allowed to offer you, or your employees, a material inducement or benefit.

You are not allowed to give or offer to give away cannabis or cannabis accessories to someone without charge. You cannot offer things or services to induce a person to purchase cannabis.

Inducements between licensed producers and retailers

The Registrar’s Standards for Cannabis Retail Stores generally prohibit licensees from entering into agreements for items, benefits, payments, or services with licensed producers (LPs) and their representatives with the purpose to promote or increase the sale of a particular product by the licensee or their employees. In other words, licensees are not allowed to ask for or accept material inducements.

There are several exemptions to this general prohibition, which are listed below, with some additional context.

Items, Benefits or Services of Nominal Value:

The standards under Section 6.0: Advertising and Promotions state that licensed retailers may accept or enter into agreements with an LP or their representative for items, benefits or services of nominal value. Nominal value items, benefits or services, unlike financial or material inducements, are those that are of inconsequential value.

The AGCO does not prescribe a specific monetary value for what constitutes an item, benefit or service of nominal value. The determination is contextual and considers a number of factors which may include:

- Are you likely to change your behaviour toward an LP or the LP’s product after receiving an item, benefit or service?

- If yes, then this item, benefit or service would not be considered to be of nominal value

- Is the item, benefit or service valued at an amount that defrays your operational costs?

- Nominal value would not be significant enough to defray operational costs

- How many items, benefits or services have been provided over a period of time?

- Nominal value is associated with a low volume of benefits over a period of time (i.e., the benefits are provided infrequently, and do not add up to a substantial value over time)

The following is a list of examples of items, benefits or services that may be considered nominal. Note that this list is not exhaustive, and it is possible for these examples to be material inducements, depending on the contextual factors above.

- T-shirts

- Hats

- Lanyards

- Inexpensive cannabis accessories

- Gift bags of inexpensive items related to cannabis

Items, Benefits and Services Related to Education or Training:

Standard 6.5 also allows licensed retailers to accept items, benefits or services that are related to education or training. Examples of items, benefits and services related to education and training may include:

- Education or training sessions or materials

- Including education or training outside of the licensed retail store (e.g., participating in such a session as part of a tour of an LP’s facility)

- Modest meals and refreshments during the education or training

- Cannabis product samples directly related to education or training

- The expectation is that sample sizes would be a small quantity of a particular strain of cannabis or product available in Ontario

- Samples of a particular strain of cannabis or product should be received infrequently

Sale of Business Data:

The sale or sharing of personal customer information continues to be prohibited by Canadian law, unless expressly consented to. Licensed retailers may enter into agreements with LPs for the sale of data for business intelligence purposes. The AGCO expects that the fee charged by the licensee and paid for by the LP should be at fair market value. Licensed retailers are expected to follow applicable privacy laws and regulations.

Ownership Interests and Franchise Agreements:

Financing and lease agreements, as well as franchise agreements between retailers and LPs or their affiliates, are permitted under Standard 6.5.

Store Brand Cannabis Products:

Agreements between retailers and LPs for store brand cannabis products (also known as white labels, private labels, private brands, and in-house/house brands) are permitted under Standard 6.5.

Nature of Permissible Activities

Standard 6.6 sets out constraints on agreements that are permissible under Standard 6.5, to ensure that they are not used as a method for material inducements.

Agreement between retail licensees and LPs must not:

- Define the amount of product from the licensed producer or its affiliates that must be offered for sale at the retail store;

- Require a defined amount of display space in the retail store to be dedicated to product from the licensed producer or its affiliates;

- Provide merchandising, marketing or promotional activities to the licensed producer or its affiliates; or

- Restrict the ability of the licensed producer or its affiliates to sell its product at other retail stores, or the ability of the licensee to sell products from other licensed producers or their affiliates.

Prohibited Activities

Aside from the exemptions set out in Standard 6.5, the Standards on inducements set out a general prohibition on agreements for items, benefits, or services between licensed retailers and LPs and their representatives.

Examples of prohibited activities include:

- Sale of in-store or online advertising space

- Licensed retailer requiring or receiving payments from an LP for advertising of the LP

- Licensed retailer co-branding advertisements with LPs (i.e., sharing the cost of content development for the purposes of marketing and promotional activities)

- Product features in-store or online

- Licensed retailers requiring or receiving payments from LPs for advertising space, preferred shelf placement of products, or promotional activities either in-store or online

- Cannabis for sensory display purposes

- Licensed retailers receiving cannabis for sensory display purposes from LPs

- Fixtures or physical assets

- Licensed retailers receiving physical assets (e.g., branded and non-branded refrigerators, televisions, computers, projectors, monitors for product listing boards, appliances such as rosin presses) from LPs

- Items essential to the operation of the business

- Licensed retailers receiving things from an LP that could be considered essential to the operation of their business (e.g., staff uniforms, furniture, appliances, renovations, point of sale system or equipment, security equipment)

- Sale incentives

- Licensed retailers or their employees receiving any benefits from an LP tied to the sales performance of any given product or brand (e.g., concert tickets, gaming consoles, luxury goods)

- Cash or rebates

- Licensed retailers receiving cash or cash rebates, product or product rebates, or price discounts from LPs in exchange for listing particular products at below-market prices

- Travel or accommodation for education or training

- Licensed retailers or their employees receiving travel or accommodation related to education or training, directly or indirectly from LPs

- Monetary compensation for education or training

- Licensed retailers or their employees receiving monetary compensation for receiving education or training from LPs

Recordkeeping

If you enter into an agreement pursuant to Standard 6.5, you must follow the additional record keeping requirements set out in Standard 8.1, requirement 10.

To meet cannabis regulatory requirements under Standard 8.1, requirement 10, you are required to:

- track agreements and acceptance of items, benefits or services (re. Standard 6.5) using the AGCO Cannabis Regulatory Reporting Template for Registrar’s Standard 8.1.10

As with any other records under Standard 8.1, these records must be made available to the AGCO upon request.

Advertising and Promotion

Under the Cannabis Licence Act, 2018 (CLA) and Regulation 468/18, the Registrar has the authority to establish standards and requirements with respect to a number of areas, including advertising and promotional activities.

Information about the standards and requirements for advertising and promoting cannabis, cannabis accessories or the sale of cannabis can be found in section 6 of the Registrar’s Standards for Cannabis Retail Stores.

Please note cannabis retail store operators are subject to the federal Cannabis Act and its regulations, which outline permissible and prohibited advertising and promotional activities.

July 1, 2020 amendments to the Smoke Free Ontario Act exempt cannabis retail stores from the ban on the display of vapour products and clarify that cannabis retail stores may sell flavoured cannabis vape products.

In general, advertising and promotion includes any public notices, representations or activities that aim to attract attention to cannabis, cannabis accessories or the sale of cannabis.

Monetary Penalties - Cannabis

Monetary penalties are one of the compliance tools the AGCO may use when licensed operators, retail store managers or authorized stores are found to have acted out of compliance with the Cannabis Licence Act, 2018 (CLA), its regulation or the Registrar’s Standards for Cannabis Retail Stores.

A monetary penalty is a financial consequence that a licensee or authorized retailer is required to pay as a result of a contravention of the CLA, regulations or standards. Monetary penalties are a step towards ensuring compliance that allows the AGCO to take appropriate regulatory action that is greater than a warning but not as severe as a licence or authorization suspension or revocation. The use of monetary penalties aligns Ontario with the majority of other Canadian jurisdictions, which have some form of monetary penalty system.

Schedule of Monetary Penalties: Cannabis Licence Act, 2018 and Regulation 468/18

For more information, see the Monetary Penalties page.

Objectives of Cannabis Legislation and Regulations

The federal government of Canada has legalized recreational cannabis in Canada. The Cannabis Act is the legal and regulatory framework for controlling the production, distribution, sale and possession of recreational cannabis in Canada and was put in place by the federal government with the purpose of keeping cannabis out of the hands of youth, keeping profits out of the pockets of criminals and protecting public health and safety by allowing adults access to legal cannabis.

Under the Cannabis Act, each province and territory is responsible for setting its own rules for how cannabis can be sold, where stores can be located, and how stores must be operated. Provinces and territories may also set additional restrictions they feel are necessary. As a result, the Government of Ontario has worked to implement a safe, legal system for cannabis retail that is intended to protect youth, protect roads and combat the illegal market for cannabis.

Under Ontario’s regulatory model, the AGCO has been given the responsibility of licensing eligible retail store operators, authorizing cannabis retail stores and regulating the sale of cannabis. The AGCO’s focus is on the safe, responsible and lawful sale of cannabis, consistent with the legislation enacted by the provincial government. Its regulatory objectives are to ensure that the retail sale of cannabis in Ontario is carried out with honesty, integrity and in the public interest as set out in the Cannabis Licence Act, its regulations and the Registrar’s Standards for Cannabis Retail Stores.

Ontario's Cannabis Retail Regulation Landscape

Legal Cannabis Supply Chain

Health Canada regulates the cultivation and processing of cannabis and licenses producers, called “Licensed Producers”.

Health Canada regulates the cultivation and processing of cannabis and licenses producers, called “Licensed Producers”.

Licensed Producers are the only legal growers/producers of cannabis products in Ontario.

Licensed Producers are the only legal growers/producers of cannabis products in Ontario.

The Ontario Cannabis Store is a Crown agency of the Government of Ontario and is the only legal supplier (wholesaler) of cannabis for private retail stores in Ontario. The OCS operates the provincial online store for recreational cannabis sales in Ontario. The AGCO does not regulate the OCS.

The Ontario Cannabis Store is a Crown agency of the Government of Ontario and is the only legal supplier (wholesaler) of cannabis for private retail stores in Ontario. The OCS operates the provincial online store for recreational cannabis sales in Ontario. The AGCO does not regulate the OCS.

The Licences and Authorizations you need from the AGCO

Retail Operator Licence

To be able to legally open a retail store to sell recreational cannabis, you must get a Retail Operator Licence. To get this licence, you must meet all of the eligibility criteria set out in the Cannabis Licence Act and its regulations.

A Retail Operator Licence allows you to operate one retail store in Ontario.

Retail Store Authorization

You must have a Retail Store Authorization for your store. The Cannabis Licence Act and its regulations require that each store meet certain requirements. Requirements relate to such matters as the store layout and location. The regulations also give residents of the municipality in which the proposed store would be located the opportunity to provide their input.

Cannabis Retail Manager Licence

In order to ensure the responsible sale of cannabis, there must be at least one licensed manager for each authorized store location. The Cannabis Licence Act and its regulations set out eligibility criteria for the person who will have management responsibilities in authorized stores. This includes having responsibility for the cannabis inventory, for hiring and managing employees, and for ensuring the store operates with honesty and integrity at all times.

If you are a sole proprietor, or in a partnership between two or more individuals, and will be both the licensed operator and performing the duties of the retail store manager for a particular store, you do not need to get a Cannabis Retail Manager Licence for your store.

The Local Community

Municipalities

Ontario municipalities had a one-time option to opt out of having cannabis retail stores in their communities. Municipalities had until January 22, 2019 to inform the AGCO if they wish to opt out. Municipalities that choose to opt out can opt back in at any time—but once they are in, they may no longer opt out.

Residents

Residents in the municipality of a proposed cannabis store location have an opportunity to share their views with the AGCO before a retail store is authorized. The Registrar must refuse to authorize the store if it is in the public interest to do so.

The only areas of public interest the Registrar can consider, as defined by the regulations, are related to public health and safety, protecting youth and restricting their access to cannabis, and preventing illegal activities in relation to cannabis.

First Nations Communities

Delivery to First Nations communities is permitted unless the community has requested delivery be restricted.

First Nations band councils wishing to restrict delivery to their community can submit a band council resolution (BCR) to the AGCO. The AGCO will notify all retailers when a BCR is received and the restriction would come into effect 30 days after such notice is provided, after which point any delivery to the First Nations community would not be permitted.

Cannabis Licence Act, 2018

The full text of the Cannabis Licence Act, 2018 can be viewed on the government of Ontario’s website.

Ontario Regulation 468/18 made under the Cannabis Licence Act, 2018

The Full Text of Ontario Regulation 468/18 made under the Cannabis Licence Act, 2018 can be viewed on the Ontario government website.

Registrar's Standards for Cannabis Retail Stores

(Last Update: June 2022)

Introduction

The Cannabis Licence Act, 2018 (CLA) and Regulation 468/18 provide the Registrar with authority to establish standards and requirements in the following areas:

- store premises, equipment and facilities, including surveillance and security

- the prevention of unlawful activities

- advertising and promotional activities

- training and other measures related to the responsible use, sale or distribution of cannabis

- the protection of assets

- record-keeping and measures to maintain confidentiality and security of records

- compliance with the federal cannabis tracking system.

These Standards are outlined in the Registrar’s Standards for Cannabis Retail Stores. Licensees are required to comply with the Registrar’s Standards for Cannabis Retail Stores, as well as all applicable laws and regulations, including the Cannabis Control Act, 2017 (CCA), the Cannabis Licence Act, 2018 (CLA), and Ontario Regulation 468/18.

The objective of a standards-based regulatory model is to shift the focus from requiring licensees to comply with a specific set of rules or processes, toward the broader regulatory outcome or objectives they are expected to achieve. Since there may be many ways for a licensee to meet the Standards, licensees have the flexibility to determine what works best for their business, thereby strengthening regulatory outcomes without needlessly burdening regulated entities.

Holders of a Retail Operator Licence are responsible for meeting all Standards. Where not specified otherwise, Standards also apply to holders of a Retail Manager Licence.

The Registrar’s Standards for Cannabis Retail Stores will be reviewed and revised on a regular basis to ensure that they are effective in mitigating risks as the cannabis retail sector matures.

Click here for the Registrar’s Standards for Cannabis Retail Stores

Click here for the Registrar’s Standards for Cannabis Retail Stores using the Point-of-Sale Data Reporting Platform

Cannabis Licensing and Application Process

Cannabis Retail Licensing

The Alcohol and Gaming Commission of Ontario (AGCO) is responsible for administering the Cannabis Licence Act, 2018 (CLA) that, together with the regulation made under the CLA , establish the licensing and regulatory regime for most aspects relating to the retail sale of recreational cannabis in Ontario. The following information is intended to assist you in applying for a Retail Operator Licence, a Retail Store Authorization and/or a Cannabis Retail Store Manager Licence.

Things to Know Before You Begin

Processing Times

- The AGCO has a dedicated cannabis licensing team to work with Retail Operator Licence, Retail Store Authorization and Cannabis Retail Store Manager applicants.

- Applications must be submitted online through the iAGCO portal and include all the required information.

- Circumstances that will delay issuance of a Retail Operator Licence include:

- Higher risk applicant eligibility factors requiring closer inspection (e.g. criminal, financial and other applicant/affiliate background considerations). For more information, please see the Cannabis Retail Licences and Authorization section of this guide

- Complex corporate structure

- Incomplete application submissions requiring multiple discussions with the applicant. For more information, please see the Application Process section of this guide

- Applicant delays in responding to the AGCO when it requests clarifications or further information

- Applicant delays in providing the AGCO with fully executed agreements with third parties and disclosure information on all parties with an interest in the business

- Circumstances that will delay issuance of a Retail Store Authorization include:

- Incomplete application submissions requiring multiple discussions with the applicant

- Applicant delays in responding to the AGCO when it requests clarifications or further information

- High volume of written submissions received through the public notice process

- The store is not ready for pre-authorization inspection

- The store does not meet pre-authorization inspection requirements.

- Please note that the Retail Store Authorization application will not be approved if it is in a municipality that has opted out of having cannabis retail stores.

Licence Holder Responsibilities

For complete details about your legal responsibilities as a licence holder, refer to the Cannabis Licence Act, 2018 and its regulations which is available online or by contacting Publications Ontario at 416-326-5300 or toll-free at 1-800-668-9938.

Personal and Entity Disclosure Requirements

There are personal and entity disclosure requirements when applying for a Cannabis Retail Operator Licence, Retail Store Authorization and Retail Manager Licence. Entity/individual disclosure information must also be provided by applicant corporations and by all corporations directly or indirectly holding 10% or more of shares. For more information, see the Personal and Entity Disclosure Requirement Guide.

Municipal Requirements

Prior to applying for a Retail Store Authorization, please check with your local municipality to ensure that your premises meets municipal requirements for retail stores and that it is not a municipality that has opted out of cannabis retail sales.

Public Notice

Once a complete Retail Store Authorization application is received by AGCO:

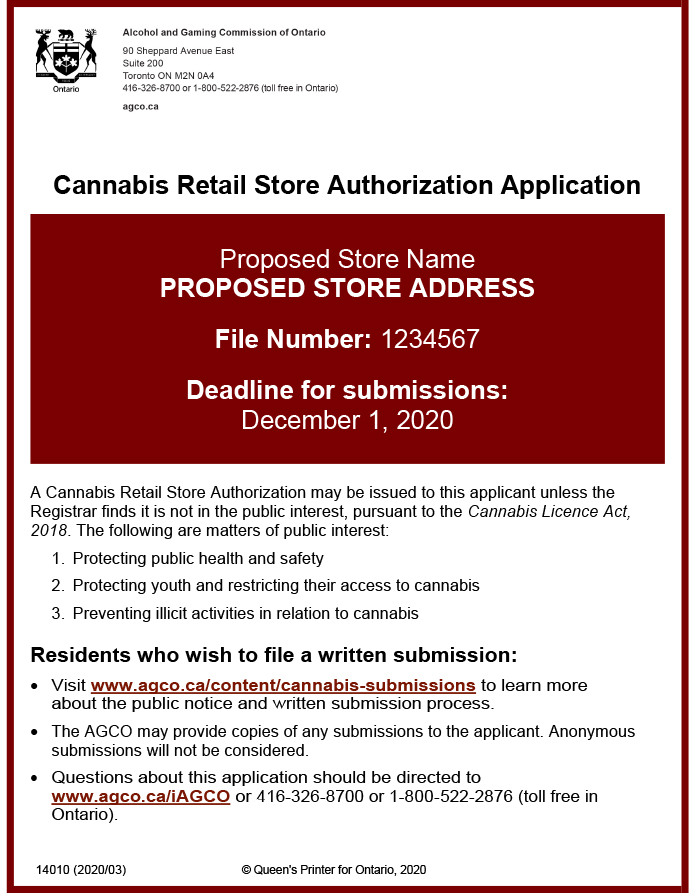

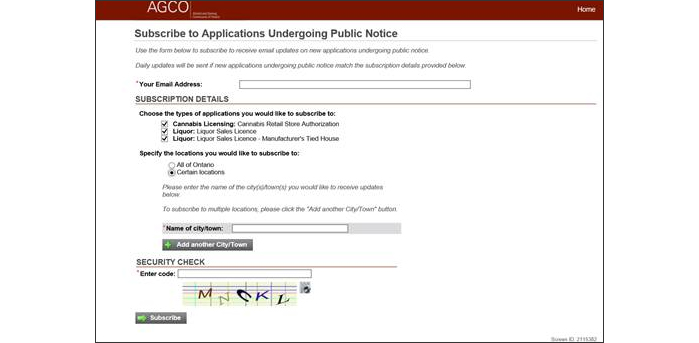

- The applicant will be notified, via iAGCO, that they have 24 hours to post a placard at the location of the proposed retail store location. The placard must be posted for 15 calendar days and it will indicate that an application has been submitted for a cannabis retail store at that location.

- All cannabis Retail Store Authorization applications that are undergoing the public notice process will be searchable on the AGCO’s iAGCO portal.

After the Public Notice period has ended, the AGCO will provide the Applicant with copies of any written submissions received from local residents and from the municipality as a result of the Public Notice Process in response to the application. Authorization applicants will have five (5) calendar days to provide a written response to the Registrar related to any written submissions received from local residents and/or the municipality and the Registrar will consider the applicant’s response, if any.

- Relevant submissions are limited to the following matters of public interest:

- Protecting public health & safety

- Protecting youth and restricting their access to cannabis

- Preventing illicit activities in relation to cannabis.

For more information on the Public Notice process, please see the Public Notice for a Cannabis Retail Store Authorization section of this guide.

Application Process for Operating a Cannabis Retail Store on a First Nations Reserve

To operate a retail store and sell recreational cannabis in a store on a First Nations reserve, you must apply for a Retail Operator Licence and a Retail Store Authorization.

- You may only apply for a cannabis Retail Operator Licence and a Retail Store Authorization if you submitted a complete Retail Store Authorization application online form through iAGCO and were one of the applications selected in the first come, first served process.

To be eligible to obtain a Retail Store Authorization, Applicants for a cannabis retail store to be located on a First Nations reserve must demonstrate that the Band Council has approved the location of the prospective cannabis retail store.

A Band Council Resolution must:

- Be uploaded as a requirement to complete the Retail Store Authorization Intent to Apply

- Approve the location of the store on the reserve

To receive a Retail Operator Licence or Retail Store Authorization for a cannabis retail store to be located on a First Nations reserve, a prospective operator must also meet all the requirements of the Cannabis Licence Act.

For more information about the application process for operating a cannabis retail store on a First Nations reserve, please see the Application Process for a Cannabis Retail Store on a First Nations Reserve web page.

Fees and Payment

Licence and Authorization Fees

- Fee

- You must pay the required fee when you first apply for a cannabis retail-related licence or authorization.

- The fees for a Retail Operator Licence, for a Retail Store Authorization or for a Cannabis Retail Manager Licence are for a two-year period, after which time you will have to renew them.

- Fee payments must be received by the AGCO before a licence or authorization application can be processed. If an application is withdrawn, or if the AGCO refuses to issue the licence or authorization for any reason, the fee is non-refundable.

- Renewal Fee

- If you wish to continue operating your business or being employed as a retail manager, you will have to pay a renewal fee before your licence or authorization expires.

- The renewal fee covers some of the ongoing costs of regulation, which includes activities such as inspection, and customer service support.

- When you renew, you can select a two-year or four-year renewal term for any of the three licence or authorization types. There is no difference in the overall cost per year.

- Fee payments must be received by the AGCO before a licence or authorization application can be processed. If an application is withdrawn, or if the AGCO refuses to issue the licence or authorization for any reason, the fee is non-refundable.

Fee Payment

- When using online services, all payments under $30,000 must be made by Visa, MasterCard, Visa Debit or MasterCard Debit.

- Payments of $30,000 or more must be made by money wire transfer or electronic funds transfer. For more information, please contact AGCO Customer Service at 416-326-8700 or 1-800-522-2876.

- Cheques and cash are not accepted as forms of payment when using iAGCO online services.

- Fee payments must be received by the AGCO before a licence or authorization application can be processed. If an application is withdrawn, or if the AGCO refuses to issue the licence or authorization for any reason, the fee is non-refundable.

- Additional fees may be required for investigations.

For more information, visit the Fees and Payment section of this guide.

Important Notice

- Each statement made in your application is subject to verification.

- It is a serious matter to knowingly provide false information on the forms and on any attachments. The provision of false, incomplete, or misleading information or the omission of information on the forms or in the documents submitted with your application, or the failure to notify the Alcohol and Gaming Commission of Ontario of any material changes to this information which occur after this application is filed, may also result in the refusal, suspension or revocation of your licence.

- If you require assistance with your application, please contact AGCO Customer Service at 416-326-8700 or 1-800-522-2876

The Ontario Cannabis Store

The Ontario Cannabis Retail Corporation (OCRC), operating as the Ontario Cannabis Store (OCS), is the exclusive wholesaler of cannabis in Ontario to authorized private retail stores. Private retailers can only purchase cannabis from the OCS. Retail store operators will be required to enter into a wholesale supply agreement with the OCS in order to begin purchasing cannabis for resale in their authorized stores.

Retail store operators should contact the OCS once they have been issued their Retail Operators Licence from the AGCO. For more information, visit learn.ocswholesale.ca or call 1-877-627-1627.

Cannabis Retail Licences and Authorizations

The following licences/authorizations are required for the operation of a cannabis retail store(s) in Ontario:

Retail Operator Licence

To operate a retail store and sell recreational cannabis, you must apply for a Retail Operator Licence. To get this licence, you must meet all of the eligibility criteria set out in the Cannabis Licence Act, 2018 and its regulations.

Eligibility

For full details on the eligibility requirements for a Retail Operator Licence, please refer to the Cannabis Licence Act, 2018, its regulations and the Registrar’s Standards.

Additionally, a person is not eligible for Retail Operator Licence:

- If the AGCO is not satisfied that you will exercise sufficient control, either directly or indirectly, over the cannabis retail business

- If you are in default of filing a tax return under a tax statute administered and enforced by the government of Ontario, or have any outstanding amounts owing and past due of tax, penalty or interest under those laws and have not made payment arrangements

- If you have a business number with the Canada Revenue Agency and have not filed a tax return under certain Federal or provincial legislation