10.6.1. Revenue Splits

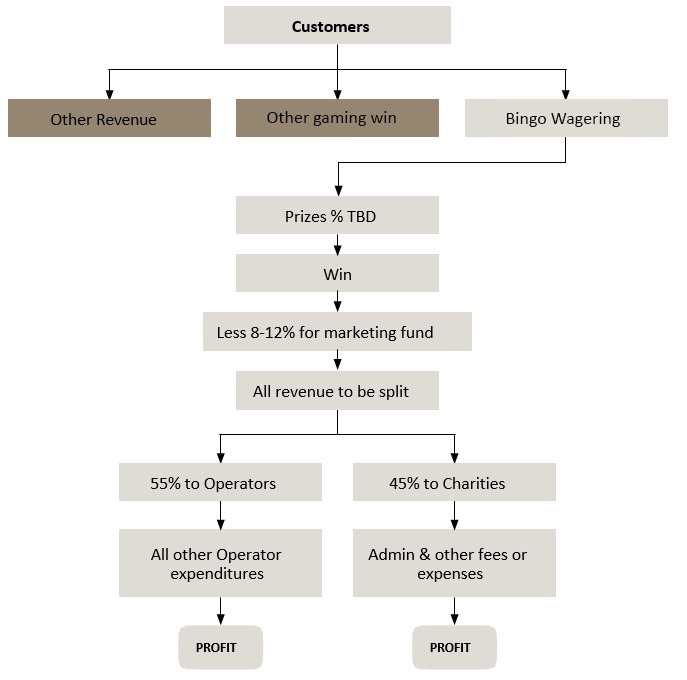

Under the Bingo Revenue Model, after payment of certain expenses, all revenue streams, from gaming and non-gaming sources are split between the charities and the Operator, with 55 per cent to the Operators and 45 per cent to the charities. As shown in Figure B below, revenue streams include:

- other revenue (for example„ food and beverage sales);

- other gaming Win (for example, break open ticket sales); and

- bingo wagering.

Key Points

- Revenues from BRM sales after prizes and the commission from the sale of Ontario Lottery Gaming (OLG) products are considered part of the revenue that is split between the Operator and the charities

- Games offered in the hall are considered part of the revenue that is split between the Operator and the charities

- There is no distinction between lottery and non-lottery revenues earned by the charities in terms of necessary and reasonable expenses and use of proceeds. The 45 per cent a licensee receives is considered lottery proceeds and must be used in accordance with the requirements on expenses and use of proceeds.

Figure B: Bingo Revenue Model – “Revenue Splits”

Where food and beverage sales at the bingo hall have been contracted out to a third party paying a monthly rental fee to the Operator, all of the gross sales from the canteen must be included in the 55/45 split between the Operator and charities.

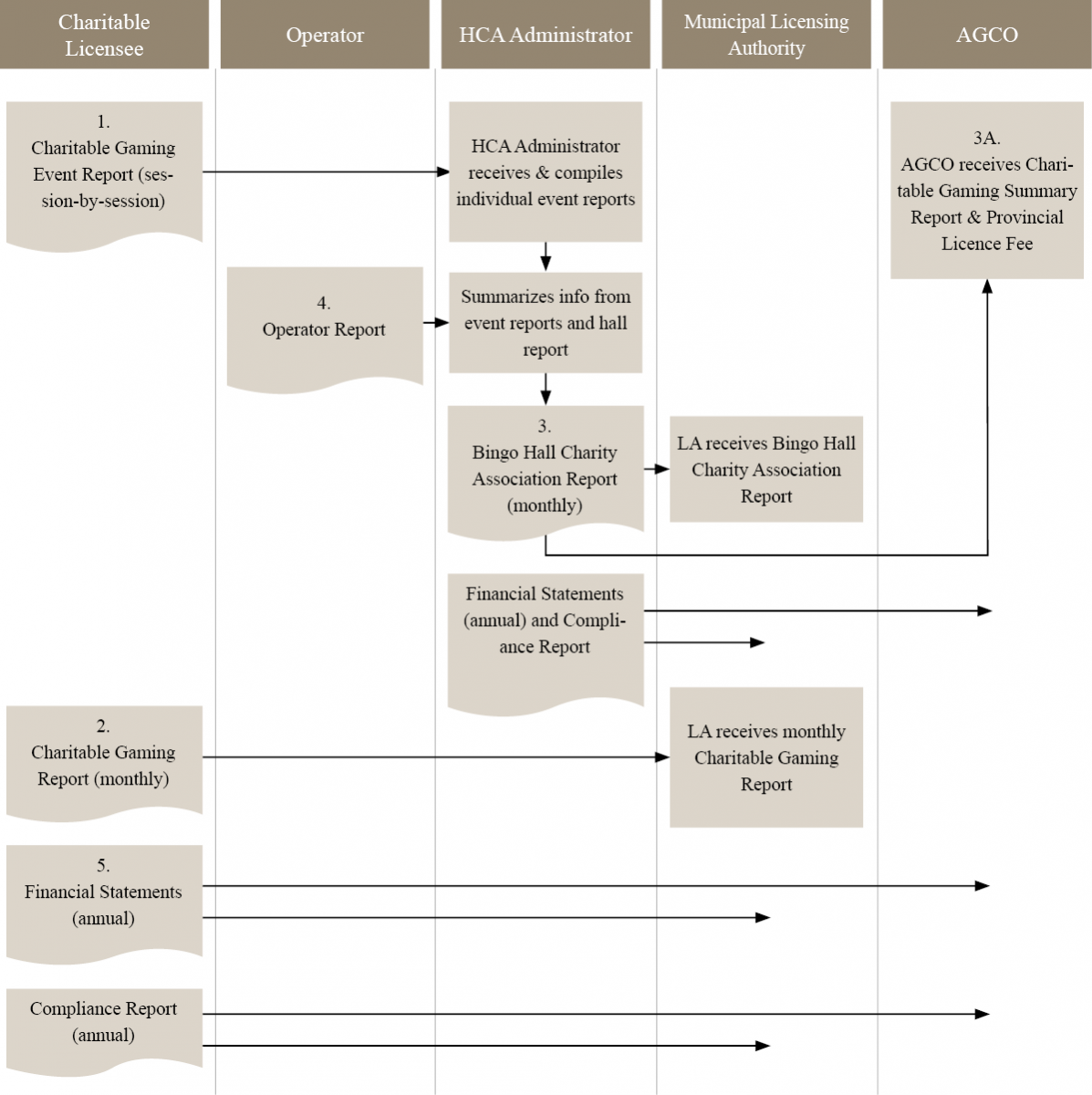

Figure C: Financial reporting process for charitable gaming events

- After payment of prizes and the five (5) per cent BOT fee directed to the HCAs (CDTA), BOT revenues (forming part of the “Other Gaming Win” revenue stream) are split, with 55 per cent flowing to the Operator and 45 per cent flowing to the charities.

- Licensees are responsible for paying licence and authorization fees and their administration costs. The Operator is responsible for all other expenses associated with supplying and selling BOTs in the hall.