2021-2022 Annual Report

Alcohol and Gaming Commission of Ontario

90 Sheppard Ave E., Suite 200

Toronto, ON, M2N 0A4

(416) 326-8700

www.agco.ca

customer.service@agco.ca

© King’s Printer for Ontario, 2023

Chair's Message

It has been a privilege and pleasure to continue to serve as Chair to the Board of Directors of the Alcohol and Gaming Commission of Ontario (AGCO) for the 2021-2022 fiscal year. The agency’s achievements have been numerous, amidst a year of changes and challenges.

I’m pleased to point out that this Annual Report is being presented in a new format, which allows us to showcase the year in review, as well as our core business delivery initiatives, strategic direction, and risk management activities. As recommended in the Office of the Auditor General of Ontario’s 2020 Value for Money Audit, the AGCO’s 2021-2022 Audited Financial Statements are included which further reflects the AGCO’s dedication to open, honest, and transparent business practices to the province, our stakeholders, and the clients we serve. New to this year’s Annual Report is the inclusion of iGaming Ontario’s (iGO) Annual Report (see Appendix 3).

On that note, a major milestone was achieved in July 2021 when the Ontario government announced the creation of iGO under new legislation as a lottery subsidiary of the AGCO. With that in place, the AGCO Board took on the responsibility to oversee iGO’s conduct and management of prescribed online lottery schemes.

This fiscal year, the AGCO was focused on releasing the regulatory framework in September 2021 for the new internet gaming line of business ahead of the market opening, which is anticipated for April 4, 2022. The regulatory framework includes operators’ standards, eligibility, and compliance requirements that positively impact Ontarians providing more options for consumers to safely, and legally, access internet casino games and sports betting within Ontario.

I would like to acknowledge the committed staff and management teams of both the AGCO and iGO, who embraced the vision and saw the potential of this new line of business and made it a reality! I’d like to make special mention of the leadership and collaboration of the staff at the Ministry of the Attorney General, Ministry of Finance and the Ontario Lottery and Gaming Corporation, without which this successful accomplishment would not have been made possible.

I’d also like to take this moment to congratulate former vice-chair, and current AGCO Board member, Dave Forestell, who was appointed Chair to the interim iGO Board of Directors and will continue to lead the iGO Board with the launch of iGO. I have had the pleasure of working closely with Dave for the last few years and am excited to see iGO’s accomplishments during these formative years, under his stewardship.

In terms of board composition, we welcome Heidi Reinhart as the new AGCO vice-chair. Heidi was appointed to the AGCO Board of Directors in the autumn of 2020 and accepted the role of AGCO vice-chair in September 2021.

I would also like to welcome the newest member of the AGCO Board, Paul Stoyan, who was appointed in July 2021 and brings a wealth of knowledge in corporate finance and corporate governance. Prior to his appointment, he lectured on several programs for the Business Law Section of the Ontario Bar Association, including programs in relation to corporate board of director liability and conflicts. His experience and knowledge will be a huge asset to the AGCO Board.

The AGCO licences and regulates in the public interest, working to provide advice and guidance to support the sectors it regulates. Several notable achievements this past year demonstrated the AGCO’s unwavering commitment to its mandate of regulating in accordance with the principles of honesty and integrity, and in the public interest. Of particular note, is that the agency worked with the Ontario government to deliver their priority of liquor modernization by implementing the new Liquor Licence and Control Act, 2019, which modernizes the rules for the retail sale and consumption of liquor in Ontario.

Diversity, Inclusion, and Accessibility (DI&A) continues to be a main initiative of the AGCO’s Corporate Plan and work is well underway to implement a strong and meaningful multi-year DI&A strategy. The Board continues to encourage, embrace, and support the agency in meeting its DI&A goals and implementing its strategy – one that ensures a culture of inclusion as an employer, and as an engaged and responsive regulator to the people of Ontario.

On behalf of the Board of Directors, I would like to express our deepest gratitude to the hardworking, dedicated executives and staff of the AGCO who have worked tirelessly to achieve all the agency’s undertakings and accomplishments in this last fiscal year.

2021-2022 was another transformative year for the agency and the Board of Directors is well- positioned to oversee the challenges and opportunities that lay ahead. We expect that the 2022- 2023 year will be another productive one as the AGCO continues to modernize its operations and regulatory frameworks in accordance with the principles of honesty and integrity, and in the public interest.

Chief Executive Officer’s Message

The 2021–2022 fiscal year saw tremendous change, challenge and opportunity for the AGCO. We modernized existing legislation, added new mandates to our portfolio and, most importantly, maintained our steadfast commitment to protecting the public interest. We also supported our customers by providing the opportunity to adapt and operate flexibly within changing circumstances while maintaining high regulatory standards.

Throughout the COVID-19 pandemic, the AGCO was resolute in ensuring we regulated while protecting the public interest. We also made sure Ontarians had continued access to the goods and services provided by our licensees and registrants. For example, we worked with the Ontario government to establish new rules allowing cannabis retailers to offer delivery and curbside pick-up services permanently beginning in March 2022. These services were first introduced as a temporary measure early in the pandemic and were positively received by cannabis retailers and consumers alike.

For the horse racing sector, we introduced a broad set of rule changes to modernize and reflect current industry practice, while ensuring integrity of the sport was maintained. This included increasing operational and economic flexibility for racing participants and enhancing equine welfare.

A new liquor framework was implemented under the new Liquor Licence and Control Act, 2019 (LLCA), which came into effect in November 2021. This framework enables the AGCO to modernize the way we regulate the sale, service and delivery of liquor and allows for a more flexible approach to regulation. The LLCA also provides enhanced social responsibility measures in line with our commitment to public protection.

Throughout the year, we continued our work with the Ontario government and the sectors we regulate to address the recommendations in the Auditor General of Ontario’s 2020 Value for Money Audit.

We finished the year on the brink of a milestone as we look forward to launching a competitive open market for internet gaming (igaming) in Ontario. We worked collaboratively with the Ontario government and iGaming Ontario (iGO) to establish a regulatory framework that protects consumers, supports market growth and enables business opportunities. With igaming operators registered, information technology systems in place and a robust compliance framework established, we are proud to support the launch of this new regulated sector. In addition, we developed a regulatory framework for single-event sports betting, which the Canadian government legalized in 2021. The AGCO will have a vital role in the regulation of this new mandate as offerings become available in the province.

As a regulatory agency serving the people of Ontario, we strive to integrate Diversity, Inclusion and Accessibility (DI&A) sustainably into our operations. This past year, we began implementing a multi-year DI&A strategy so that we can continue to effectively deliver inclusive, accessible and responsive services to our customers, stakeholders, the public and our employees.

A strong, engaged and motivated workforce is key to ensuring we deliver on our mandate of regulating in the public interest and with a customer focus. Supporting staff has been central to our success. In addition to our DI&A strategy, we introduced flexible work arrangements and new and enhanced employee wellness initiatives, which strengthen our “People First” approach.

It has certainly been a transformative year at the AGCO, and I am extremely proud of the achievements we were able to reach. I would like to express my deep appreciation for the dedication and professionalism shown by all AGCO employees as we eagerly embrace another exciting year to come.

Board of Directors

The AGCO Board of Directors (the Board) is responsible for the overall governance of the AGCO and meets regularly. In exercising its governance functions, the Board sets goals and develops policy and strategic directions for the Commission to fulfill its mandate; this includes working with the Chief Executive Officer and senior management on regulatory and governance activities.

As part of its governance structure, the Board has two standing committees. These committees are the Finance, Audit and Risk Management Committee and the Strategic Oversight and Governance Committee. The committees are accountable to the Board and provide regular updates at board meetings, highlighting key decision points, areas of substantive discussion and recommendations to the Board.

Finance, Audit and Risk Management Committee

The Finance, Audit and Risk Management Committee is responsible for providing oversight on matters related to financial performance. This committee also provides oversight on cybersecurity, internal audit activities, risk management and emergency management, including internal control systems and annual risk management and audit plans.

Strategic Oversight and Governance Committee

The Strategic Oversight and Governance Committee is responsible for ensuring the agency has an effective governance framework and is carrying out its responsibilities and fulfilling its legislative mandate. In particular, this committee is responsible for monitoring and assessing the agency’s performance against key strategies and objectives and providing strategic oversight with respect to the AGCO’s corporate social responsibility program and human resources strategy.

The list below reflects the members of the Board who served during the fiscal year ending March 31, 2022, including their original appointment dates.

Total per diems of all appointees for 2021–2022: $ 135,787.03

Table 1—Board members and per diems

|

Name |

Position as of March 31, 2022 |

Original Appointment |

Current Term Start Date |

Current Term Expiry Date |

Fiscal Year 21–22 Per Diem Payments ($) |

|---|---|---|---|---|---|

|

Lalit Aggarwal |

Chair Part-time |

June 6, 2019 |

June 6, 2020 |

June 5, 2024 |

45,739.44 |

|

Heidi Reinhart |

Vice-Chair and Member Part-time |

October 29, 2020 |

September 16, 2021 |

September 15, 2023 |

13,580.26 |

|

Neil Desai |

Member Part-time |

September 17, 2020 |

September 17, 2020 |

September 16, 2022 |

15,553.19 |

|

Dave Forestell |

Member Part-time |

December 12, 2018 |

June 20, 2020 |

June 19, 2024 |

23,427.94 |

|

Douglas McLarty |

Member Part-time Chair, Finance, Audit and Risk Management Committee |

February 20, 2020 |

February 20, 2022 |

February 19, 2024 |

16,497.19 |

|

Paul Stoyan |

Member Part-Time |

July 29, 2021 |

July 29, 2021 |

July 28, 2023 |

6,600.06 |

|

Cara Vaccarino |

Member Part-time Chair, Strategic Oversight and Governance Committee |

February 14, 2020 |

February 14, 2022 |

February 13, 2025 |

14,388.95 |

About the AGCO

Vision

A world-class regulator that is innovative, proactive, inclusive and socially responsible.

Mandate

To regulate in accordance with the principles of honesty and integrity and in the public interest.

Governing Legislation

The AGCO is an arms-length regulatory agency of the provincial government, reporting to the Ministry of the Attorney General (MAG). It was established on February 23, 1998, under the Alcohol, Cannabis and Gaming Regulation and Public Protection Act, 1996 (ACGRPPA). The AGCO continues as a corporation under a new corporate governance statute, the Alcohol and Gaming Commission of Ontario Act, 2019 (AGCO Act).

The AGCO is responsible for the administration of:

- Alcohol and Gaming Commission of Ontario Act, 2019

- Liquor Licence and Control Act, 2019

- Gaming Control Act, 1992

- Order-in-Council 208/2024 (as amended)

- Cannabis Licence Act, 2018

- Horse Racing Licence Act, 2015

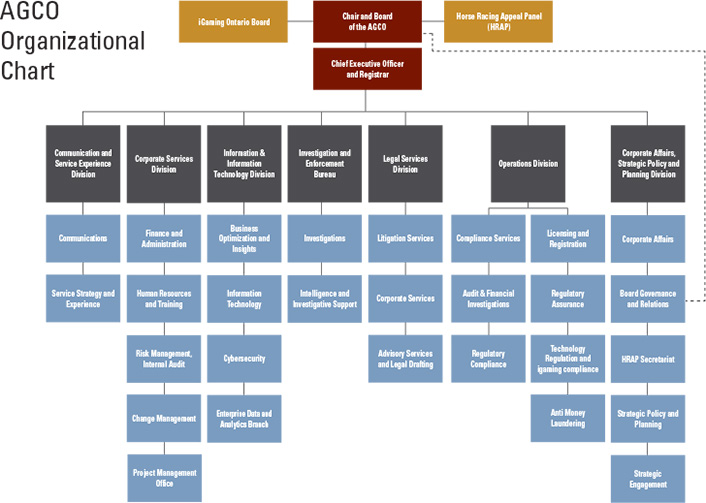

Corporate Structure

- Organizational Structure (Text Version)

-

-

- Chair and Board of the AGCO

- Horse Racing Appeal Panel (HRAP)

- iGaming Ontario Board

- Chief Executive Officer and Registrar

- Communications and Service Experience Division

- Communications

- Service Strategy and Experience

- Corporate Services Division

- Finance and Administration

- Human Resources and Training

- Risk Management, Internal Audit

- Change Management

- Project Management Office

- Information & Information Technology Division

- Business Optimization and Insights

- Information Technology

- Cybersecurity

- Enterprise Data and Analytics Branch

- Investigation and Enforcement Bureau

- Investigations

- Intelligence and Investigative Support

- Legal Services Division

- Litigation Services

- Corporate Services

- Advisory Services and Legal Drafting

- Operations Division

- Compliance Services

- Audit & Financial Investigations

- Regulatory Compliance

- Licensing and Registration

- Regulatory Assurance

- Technology Regulation and igaming Compliance

- Anti-Money Laundering

- Corporate Affairs, Strategic Policy and Planning Division

- Corporate Affairs

- Board Governance and Relations

- HRAP Secretariat

- Strategic Policy and Planning

- Strategic Engagement

- Communications and Service Experience Division

-

Communications and Service Experience Division

The Communications and Service Experience Division provides strategic communications advice and services, manages media relations and the AGCO’s public reputation and oversees the development of internal and external communication materials and publications. It builds understanding and acceptance of organizational objectives and policy priorities through regular communication with staff and stakeholders.

The Service Strategy and Experience Branch delivers on the AGCO’s Service Excellence strategic objective by working with partners across the organization to strengthen its service culture and competencies and ensuring customer needs are the “organizing principle” around policy development, service design and delivery. The branch includes the AGCO’s Contact Centre, which handles over 100,000 customer interactions yearly across a range of channels. It also provides oversight of the agency’s inquiries and complaints handling policy and practices and ensures the customer experience is monitored, measured and managed.

Corporate Services Division

The Corporate Services Division provides advice and guidance on all aspects of the AGCO’s day-to-day administration and client services and plays a strategic role as a proactive facilitator of the agency’s major change initiatives.

The Human Resources and Training Branch is responsible for supporting the People First strategic goal. The strategic goal includes full-cycle human resources operational services, wellness, employee engagement, coaching, management/labour relations, talent management and succession planning, talent data analytics/reporting and internal and external training. The Human Resources and Training Branch oversees the DI&A framework.

The Finance and Administration Branch provides financial planning and reporting, accounting, payroll, procurement (including oversight of vendor management), facilities management and mail and courier services.

The Risk Management and Internal Audit Branch undertakes internal audits, which provide reasonable assurance that the AGCO’s risk management, governance and internal control processes are operating effectively. The Branch also supports the agency’s Enterprise Risk Management framework and coordinates the Emergency Management Enterprise System, which includes the Business Continuity Plan.

The Project Management Office manages the AGCO’s priority projects. It ensures major projects stay on track, outcomes are aligned to strategic goals and the right resources are in the right place based on corporate needs.

The Change Management Office implements a change management framework for the agency by applying structured processes and tools to lead people through organizational change and helping individuals transition by engaging, adopting and implementing change.

Information and Information Technology Division

In partnership with each business area, the Information and Information Technology (I&IT) Division provides strategic advice and technology to support the AGCO’s Digital First mindset and Future of Work project. This division oversees information and information technology investment and makes it easier for people and businesses to interact and engage within the agency.

The Enterprise Data and Analytics Branch provides data analytics solutions to inform regulatory policy and operations. It optimizes service delivery and resource efficiencies to ensure alignment with the two strategic pillars of Data Analytics and Data Governance.

The Business Optimization and Insights Branch brings an enterprise-wide business lens to key optimization initiatives resulting in continuous process and business improvements across the organization. Built on continuous innovation and a framework of improvement with a digital transformation and automation mindset, this branch works with all regulated sectors to identify optimization opportunities and liaise with system and data teams.

The Cybersecurity Branch focuses on matters related to the AGCO’s regulated sectors and corporate solutions such as iAGCO, the Data Analytic platform, Enterprise Document Management and human resources and financial systems.

The IT Branch provides IT planning and roadmaps, innovative business solutions, robust technology platforms, enterprise architecture and design, AGCO system development and configuration, data management/governance and end-user solutions and operates the help desk.

Investigation and Enforcement Bureau

The Ontario Provincial Police (OPP) Investigation and Enforcement Bureau (IEB or Bureau) is assigned to the AGCO. It employs approximately 135 sworn and civilian members, fully integrated within the AGCO. The Chief Superintendent reports to an OPP Deputy Commissioner. The Bureau’s branches conduct investigations across all sectors regulated by the AGCO. The Bureau also provides investigative expertise to, and shares information with, other law enforcement services and regulatory and industry stakeholder agencies to ensure integrity and public safety within these regulated industries and sectors.

Legal Services Division

The Legal Services Division provides legal advice and services to the AGCO. This includes providing advice on the application of legislation, regulations and standards administered by the AGCO, advice and assistance in developing and drafting legislation, contracts and policies strategic direction as well as providing advice and opinions on corporate issues and initiatives. It also provides legal advice on licensee and registrant eligibility and compliance matters within the regulatory mandate and represents the Registrar at hearings of appeals before the Licence Appeal Tribunal, the Horse Racing Appeal Panel, the Divisional Court and the Court of Appeal.

Operations Division

The Operations Division has a broad mandate covering the AGCO’s daily and strategic operational activities.

The Licensing and Registration Branch (L&R), within the Operations Division, is responsible for reviewing and processing all application types, including licences, permits, authorizations and registrations, across all the sectors regulated by the AGCO. L&R also works with municipalities and First Nations overseeing the licensing of charitable lottery schemes.

The Operations Division also includes the Compliance Services Department (CS), which consists of the Audit and Financial Investigations Branch (AFI) and the Regulatory Compliance Branch (RCB). These branches conduct regulatory compliance activities, including education, inspections and compliance reviews, along with audits and financial investigations across all regulated sectors. Equipping frontline staff with the knowledge and skills to deliver regulatory services across all industries and sectors, CS deploys regional, cross-functional teams who take a comprehensive risk- and outcomes-based approach to regulatory compliance.

Inspectors and Auditors within CS respond to and proactively address compliance concerns when and where they occur, taking a multi-sector approach to reach desired regulatory outcomes. In addition, the financial investigations team in AFI conduct due diligence in support of L&R processes and financial investigations regarding allegations of fraud.

RCB includes the Racing Officials (Judges and Stewards), who supervise and officiate horse races conducted at Ontario’s licensed racetracks, as well as Veterinary Services, which oversees the health and welfare of horses during racing. Veterinary Services works with the Official Veterinarians, who are employed by the racetracks but supervised by the AGCO.

The Equine Drug Unit (EDU) is composed of inspectors from RCB and OPP investigators from IEB, who work together to conduct inspections and investigations into violations related to equine medication control. Their primary focus is to reduce the use and distribution of performance enhancing drugs within the sport through a combination of inspections and investigative techniques.

The Technology Regulation and iGaming Compliance Branch assesses, tests and approves electronic games, systems and equipment against Ontario Minimum Technical Standards, while maintaining independently confirmed accreditation against ISO 17025:2017, the general requirements for the competence of testing and calibration laboratories. Please note that with the launch of an open competitive market in internet gaming anticipated for April 2022, all testing in internet gaming will be conducted by AGCO registered Independent Testing Laboratories under the oversight of the TRC branch.

The Regulatory Assurance Branch (RAB) leads the development and implementation of tools, strategies and frameworks that assess risk and drive the AGCO’s compliance-focused approach. The RAB also works with the province’s cannabis retail store operators and the Ontario Cannabis Store to ensure the accurate reporting of recreational cannabis inventory and sales activity.

The Anti-Money Laundering (AML) Unit is committed to maintaining an effective anti–money laundering program designed to mitigate money laundering risks in AGCO regulated sectors. The team implements a risk- and evidence-based approach to AML. This approach includes conducting targeted oversight activities that assess the degree to which gaming sites not only concern themselves with transactional accountability and reporting outcomes but also focus on the risk mitigation, prevention, disruption and deterrence of suspected money laundering activities. The team maintains and fosters strong relationships with AGCO partners and stakeholders, including OLG, iGO, the OPP and the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

Corporate Affairs, Strategic Policy and Planning Division

The Corporate Affairs, Strategic Policy and Planning Division provides a variety of strategic functions to support the delivery of the agency’s mandate. The Strategic Policy and Planning Branch leads strategic regulatory policy across each sector, in addition to strategic and corporate planning. The Office of Strategic Engagement supports projects and ongoing work by leading external and internal stakeholder engagement, including management of memoranda of understanding with other regulators. The division also serves as the primary liaison with government partners to support government initiatives and conduct issues management.

The Corporate Affairs and Governance Branch is responsible for Board support and assists the Board in fulfilling its governance responsibilities. This includes ensuring key corporate accountability measures are completed within government timelines and monitoring compliance with the Memorandum of Understanding between the government and the AGCO. A dedicated and independent unit also provides administrative support to the Horse Racing Appeal Panel.

2021–2022: Year in Review

Responding to the COVID-19 pandemic

The AGCO continued to ensure the agency was well-positioned to respond to the rapidly evolving situation throughout the COVID-19 pandemic. The AGCO demonstrated a commitment to burden reduction and increased flexibility for licensees while responding with speed and agility to protect the lives and livelihoods of Ontarians.

In the early stages of the COVID-19 pandemic, the AGCO introduced the Registrar’s Standards for Gaming to support the safe re-opening of land-based gaming sites across the province.

Gaming site operators were required to establish re-opening plans that demonstrate their compliance with various public health requirements to prevent the spread of COVID-19 at physical gaming sites. These plans were required to be assessed by an infectious disease subject matter expert and submitted to the AGCO for review by the RAB using the hierarchy of controls. In addition, operators were required to provide on-going COVID-19 pandemic compliance self-assessments in addition to the requirements set out in the AGCO Notification Matrix around COVID requirements.

In November 2020, AGCO inspectors took on expanded responsibility in support of the Province’s approach to enforcing public health measures implemented under the Reopening Ontario (A Flexible Response to COVID-19) Act, 2020 (ROA). AGCO inspectors were designated as Provincial Offences Officers with the authority to enforce measures in place under the ROA. On a regular basis throughout the pandemic, we worked closely with our partners, including police, public health and municipalities, to ensure all licensees were meeting their obligations under the ROA. To further support this compliance work RCB participated in the Provincial Multi-Ministry Teams (MMT) and had 34 inspectors volunteer to participate in the MMT campaigns conducted throughout the province to enforce the ROA.

The AGCO is committed to ensuring that all sectors are operated in accordance with the law, and with integrity and honesty. With respect to the AGCO’s approach during the ROA, CEO and Registrar Tom Mungham set the tone when he said, “The AGCO has zero tolerance for licensed establishments that are not doing their part to keep their customers and staff safe by following public health rules and Ontario’s laws.” During the 2021–2022 fiscal year, the AGCO suspended and issued Notice of Proposals (NOP) to revoke licences for infractions of the Liquor Licence Act, the predecessor legislation to the Liquor Licence and Control Act, to six liquor licence holders.

The AGCO worked quickly and efficiently to analyze the impact of the evolving COVID-19 situation on the AGCO and its regulated sectors and to develop products to support their operations in uncertain times. A dedicated web page was created to provide licensees and operators across the AGCO’s lines of business with up-to-date information on the range of measures in place that were relevant to those particular businesses and sectors. This allowed the AGCO to act quickly and ensure that important messages were delivered to stakeholders clearly and in a timely manner, with additional clarification either through communications, guidance or updates to regulations.

Government initiatives, priorities and mandate letter

As a provincial government agency, the AGCO supports and delivers on the Ontario government’s public policy priorities and fiscal objectives. The AGCO continues to ensure its priorities and operations align with government direction and ensure cost-effective, customer- focused service delivery. Government priorities are embedded in our approach, as evidenced in our work on igaming, liquor modernization and the Auditor General of Ontario Report, which stem directly from the Attorney General’s direction in our mandate letter.

Sustainability and efficiency

The AGCO is committed to good stewardship of public resources and has adopted a comprehensive transformation agenda to modernize its regulatory approach, business processes and workplace environment. The agency’s modernization efforts support and align with key government objectives for enhanced efficiency in delivering public services and reducing regulatory burden.

The AGCO is undertaking a fee review of the liquor and cannabis sectors in response to the Auditor General of Ontario’s recommendation to fully recover costs through the setting of regulatory fees in the liquor and cannabis sectors to become a more self-sufficient regulatory agency. The AGCO will work with MAG to develop options to support increased cost recovery in the liquor and cannabis sectors as part of this review.

Supporting jobs and business

The AGCO seamlessly maintained the delivery of services during the COVID-19 pandemic largely due to the modernization efforts that were already underway, which enabled it to adjust and respond to the pandemic quickly.

The agency introduced a number of regulatory–burden reduction initiatives to support the liquor sector during the COVID-19 pandemic, some of which have been made permanent and incorporated into the LLCA. In previous years, this included takeout and delivery for eligible licensed establishments, accommodating the business model of food box programs within the liquor delivery service licence, and providing the sale and service of liquor on docked boats. In Fiscal Year 2021–2022, the AGCO permanently allowed for the sale of beer at farmers’ markets.

Risk management

The AGCO continued to develop and implement an effective process for identifying, assessing and mitigating risks, including planning for and responding to emergency situations. In January 2022, the Senior Management Team undertook an enterprise risk exercise to understand the agency’s priority risk areas, including responding to the COVID-19 pandemic. The AGCO continues to develop and make improvements to its business continuity plan.

Workforce management

Over the past year, the AGCO focused on ensuring its structure can support the introduction of igaming in Ontario while regulating its current sectors. As a result of igaming implementation, a number of new job positions were introduced across the agency. The AGCO also developed a shared-service model to streamline functionality and services while mitigating conflict of interest.

In addition, the Business Optimization and Insights (BOI) Branch, with a dual mandate of performance measurement and process improvement and identifying opportunities for innovative practices and improved program sustainability, implemented more than 10 BOI identified recommendations. For example, as of January 2022, automated approvals for renewal licence applications have increased by an average of 29% since September 2021.

Digital delivery and customer service

The AGCO has completed its transition to the web-based iAGCO portal through which people can access online services. iAGCO improves and modernizes AGCO’s service delivery by offering customers an easy, convenient, digital way of doing business. Through this platform, the AGCO ensured the delivery of services during the COVID-19 pandemic. The AGCO continued to improve the iAGCO service model and was able to leverage the launch of its igaming services on this platform to establish service upgrades to the system.

Under the AGCO Service Strategy and Experience initiatives, the design and delivery of an optimal service experience for our customers is a multi-faceted endeavour involving a range of areas from across the AGCO.

The iAGCO Product Management Team is working closely with Service Strategy and Experience to understand customer feedback and usage. Insights from customers’ experience with the iAGCO online service delivery portal and the AGCO’s website are routinely reviewed. Opportunities to meet and exceed the customer experience will be considered and prioritized in future system changes. This analysis will provide a roadmap to continue evolving and making quick fixes to address customer issues wherever possible.

To reflect changing customer service preferences and shifts, the AGCO has updated its in- person service model to be by appointment only. All AGCO services are available online, with staff available to assist customers by phone, chat, email and video chat.

The online engagement tool, ConnectAGCO, is one of AGCO’s Digital First tactics. It proved to be effective in engaging fairly and transparently with a wide range of stakeholders, including international organizations and in different time zones. This platform also permitted the AGCO to track its engagement metrics and nimbly respond to igaming project timelines.

Following government direction, an initial analysis has been undertaken to identify opportunities and considerations for the AGCO and its regulated businesses relating to the government’s Digital ID initiative.

AGCO's Core Business Delivery

Licensees, registrants and authorization holders

The AGCO provides services to a wide group of licensees, registrants and authorization holders. The following tables outline AGCO’s currently active licensees, registrants and authorization holders as of March 2022. It also shows the information from the previous fiscal year.

Please note that due to the name changes impacting several licence, registration and authorization types, some of which resulted in re-categorization, there is some variance from the numbers reported in the 2020–2021 Annual Report.

Table 2—AGCO licensees and registrants

|

|

2020–21 |

2021–22 |

|---|---|---|

|

Alcohol Industry/ Licensees (Special Occasion Permits excluded) |

33,034 |

32,381 |

|

Gaming & Lottery Registrants |

29,305 |

25,828 |

|

Horse Racing Licensees |

15,951 |

12,106 |

|

Cannabis |

3,361 |

5,485 |

Table 3—Total number of liquor licences

|

|

2020–21 |

2021–22 |

|---|---|---|

|

Liquor Sales Licensed Establishments |

18,464 |

17,872 |

|

Ferment-on-Premise Facilities |

468 |

403 |

|

Liquor Delivery Services |

582 |

707 |

|

Manufacturers (By-the-Glass Included) |

1,286 |

1,307 |

|

Manufacturers’ Representatives |

1,065 |

1,097 |

|

Grocery Store Licences |

519 |

502 |

|

Onsite and Offsite Retail Stores |

1,017 |

1,034 |

|

Other Endorsements |

9,633 |

9,459 |

Note:

- The implementation of the LLCA in November 2021 resulted in adjustments to certain licence categories.

- Grocery Store Licences, Onsite and Offsite Retail Store Endorsements, and Other Endorsements are now included in this table.

- There is a variance between numbers reported in this table for 2020–21 Liquor Sales Licensed Establishments and Manufacturers (By-the-Glass Included) and what was reported in the 2020–2021 Annual Report as a result of changes to licence categories.

Table 4—Total number of gaming registrations

|

|

2020–21 |

2021–22 |

|---|---|---|

|

AGCO Subsidiary (iGO) |

- |

1 |

|

Gaming Assistant |

17,435 |

13,450 |

|

Gaming-Related Supplier—Lottery (not OLG or BOT) |

16 |

17 |

|

Gaming-Related Supplier—Manufacturers |

47 |

50 |

|

Gaming-Related Supplier—Other |

70 |

76 |

|

Non-Gaming Related Supplier |

305 |

280 |

|

Operator—Charitable—3 or less events per week |

7 |

7 |

|

Operator—Charitable—4 or more events per week |

59 |

56 |

|

Operator—Commercial |

34 |

36 |

|

Seller |

10,320 |

10,449 |

|

Trade Union |

19 |

18 |

|

Total |

28,312 |

24,440 |

Note:

- igaming is a new line of business to be launched in April 2022, therefore there are no active registrations for that sector in 2020–21.

- The “AGCO Subsidiary” indicated in the table above is the registration for the Lottery Subsidiary iGaming Ontario.

Table 5—Total number of cannabis licences and authorizations

|

|

2020–21 |

2021–22 |

|---|---|---|

|

Cannabis Retail Manager Licence |

1,618 |

2,494 |

|

Cannabis Retail Operator Licence |

1,049 |

1,407 |

|

Cannabis Retail Store Authorization |

694 |

1,584 |

|

Total |

3,361 |

5,485 |

Table 6—Total number of horse racing licences

|

|

2020–21 |

2021–22 |

|---|---|---|

|

Thoroughbred |

- |

4,651 |

|

Quarter Horse |

- |

375 |

|

Standardbred |

- |

7,267 |

|

Teletheatres |

48 |

51 |

|

Racetracks |

15 |

15 |

Note:

- Total number of horse racing licences grouped by horse breed is a new data point added to the report this year.

- Individuals in the horse racing sectors can hold a licence allowing them to work across breeds (Thoroughbred, Quarter Horse, and Standardbred).

- The counts per breed are not mutually exclusive of each other; this means that an individual licence may be counted more than once across the Standardbred, Thoroughbred or Quarter Horse categories.

Licensing and registration activities

The Licensing and Registration Branch (L&R) of the AGCO’s Operations Division is responsible for reviewing and processing applications for licences, permits, authorizations and registrations for the sectors regulated by the AGCO. Eligibility Officers, Senior Eligibility Officers and Managers review applications and supporting materials to assess an applicant’s eligibility to hold a particular licence, permit, authorization or registration. When necessary, they enlist the services of additional AGCO departments to facilitate further review or investigation of an application, such as the Regulatory Compliance Branch (RCB), the OPP Investigation and Enforcement Bureau (IEB), and the Audit and Financial Investigations Branch (AFI).

Additionally, L&R reviews and processes applications regarding renewing all licences, permits, authorizations, registrations and amendment applications received to amend or update information pertaining to an establishment or licensee.

As part of the AGCO’s risk-based licensing approach, L&R considers various factors in its review. These factors include an applicant’s type of business, location, compliance history and experience. Some establishments pose a greater risk to public safety, public interest and/or non-compliance with the law. Additionally, when reviewing an application, past conduct, financial responsibility, experience/training and honesty/integrity of an applicant are considered. If the Registrar believes that the issuance of a licence or registration is not in the public interest, the Registrar may issue a Notice of Proposal (NOP) to review or refuse to the applicant or licensee, who may request a hearing on the NOP before the Licence Appeal Tribunal (LAT).

During this assessment, L&R uses AGCO Board–approved criteria to assess the risk(s) posed to public safety and public interest and non-compliance with the law. All potential risks and concerns are reviewed to determine if the licence, permit, authorization or registration should

have a Level I, Level II or Level III risk designation or no designation at all. A risk designation ensures the AGCO focuses the appropriate resources towards the licensee and the establishment to ensure compliance is always maintained. If the Registrar believes that a licensee may require additional assistance or support to remain compliant with the applicable acts and/or the Registrar’s Standards, additional conditions may be attached to their licence, permit, authorization or registration. L&R performs risk-based assessments during the lifetime of all licences, permits, authorizations and registrations to ensure potential risks posed by a licensee or establishment are considered and evaluated.

The following tables outline the number of licences and registrations issued during the fiscal year. It is important to note that the following tables represent applications that have been approved and issued, not all applications submitted. In addition to this, some of the variance is due to the fact that tables now also show renewal and amended licences and registrations.

Table 7—Liquor licences issued, renewed and amended

|

|

2020–21 |

2021–22 |

|---|---|---|

|

Liquor Sales Licensed Establishments |

3,400 |

6,988 |

|

Ferment-on-Premise Facilities |

56 |

227 |

|

Liquor Delivery Services |

308 |

275 |

|

Manufacturers (By-the-Glass Included) |

375 |

505 |

|

Manufacturers’ Representatives |

234 |

244 |

|

SOPs Issued |

3,452 |

18,046 |

|

Beer Store—store location approvals |

11 |

9 |

|

Grocery Store Licences |

76 |

282 |

|

Onsite and Offsite Retail Stores |

225 |

410 |

|

Other Endorsements and Authorizations |

2,028 |

3,920 |

Table 8—Gaming registrations issued, renewed and amended

|

|

2020–21 |

2021–22 |

|---|---|---|

|

AGCO Subsidiary (iGO) |

- |

1 |

|

Gaming Assistant |

3,391 |

14,491 |

|

Gaming-Related Supplier–Lottery (not OLG or BOT) |

4 |

8 |

|

Gaming-Related Supplier—Manufacturers |

18 |

70 |

|

Gaming-Related Supplier—Other |

21 |

72 |

|

Non-Gaming Related Supplier |

71 |

147 |

|

Operator—Charitable—3 or less events per week |

0 |

5 |

|

Operator—Charitable—4 or more events per week |

11 |

16 |

|

Operator—Commercial |

25 |

40 |

|

Operator—Internet Gaming |

- |

23 |

|

Seller |

1,555 |

2,764 |

|

Trade Union |

4 |

10 |

Note: The “AGCO Subsidiary” indicated in the table above is the registration for the Lottery Subsidiary iGaming Ontario.

Table 9—Charitable lottery licences issued, renewed and amended

|

|

2020–21 |

2021–22 |

|---|---|---|

|

Bingo Event Licence |

7 |

7 |

|

Bingo Hall Charity Association Licence |

79 |

141 |

|

Break Open Ticket Licence • Issued in conjunction with another licensed event. |

27 |

32 |

|

Charitable Gaming Eligibility • New category introduced in October 2021 |

208 |

284 |

|

Loonie Progressive Licence • Issued in unorganized territory, First Nations or issued in conjunction with a bingo event licence. |

6 |

8 |

|

Progressive Bingo Licence • Issued in conjunction with a Bingo Event Licence |

1 |

1 |

|

Provincial Break Open Ticket Licence |

40 |

33 |

|

Raffle Licence |

756 |

1,550 |

|

Social Gaming Licence |

- |

59 |

|

Special Occasion Gaming Licence • Renamed Social Event Gaming Licence in October 2021 |

- |

2 |

|

Super Jackpot Licence • Issued in conjunction with a Bingo Event licence |

2 |

- |

Note:

- Due to this sector transitioning to iAGCO in October 2021, the numbers reported for 2020–21 vary from the 2020–21 annual report.

- The Social Event Gaming Licence was launched in October 2021; there are no numbers to report for the 2020–2021 fiscal year.

- The Special Occasion Gaming Licence was launched in October 2020, resulting in low numbers issued.

- The Social Gaming Licence is not issued under the charitable component of the Criminal Code. All wagers under this licence are paid out to winners and this is not a charitable fundraising opportunity.

Table 10—Cannabis licences and authorizations issued, renewed and amended

|

|

2020–21 |

2021–22 |

|---|---|---|

|

Cannabis Retail Manager Licence |

1,390 |

944 |

|

Cannabis Retail Operator Licence |

891 |

533 |

|

Cannabis Retail Store Authorization |

733 |

1,186 |

|

Total |

3,014 |

2,663 |

Note: There is a variance between numbers reported in this table for 2020–21 Cannabis Retail Store Authorizations and what was reported in the 2020–2021 Annual Report, as this data now includes new, renewed and amended applications.

Table 11—Horse racing licences issued, renewed and amended

|

|

2020–21 |

2021–22 |

|---|---|---|

|

Thoroughbred |

3,094 |

4,927 |

|

Quarter Horse |

325 |

465 |

|

Standardbred |

3,614 |

7,746 |

|

Teletheatres |

54 |

36 |

|

Racetracks |

133 |

97 |

Note: There is a variance between numbers reported in this table for 2020–21 and what was reported in the 2020–2021 Annual Report, as this data now includes new, renewed and amended applications.

Table 12—Response to Public Notices—Alcohol and cannabis

In addition to issuing licences, registrations and authorizations across all regulated sectors, L&R also manages responses to public notices during the application process: objections (Liquor Sales Licence) and written submissions (Cannabis Retail Store Authorization).

|

|

2020–21 |

2021–22 |

|---|---|---|

|

Objections (Liquor Sales Licence) |

2,823 |

163 |

|

Written Submissions (Cannabis Retail Store Authorization) |

9,393 |

2,214 |

Compliance activities

The AGCO inspects, monitors and educates to ensure compliance with applicable laws and regulations. The AGCO’s compliance approach is risk-based and outcome-focused.

- Risk-based refers to the regulatory risks underlying the Standards, regulations, laws and requirements. A risk-based compliance approach focuses the greatest resources on mitigating the highest risk areas.

- Outcome-focused means emphasizing the results that regulated sectors are meant to achieve, rather than prescriptive activities that must be carried out.

The compliance activities emphasize monitoring through a series of inspection activities, including unannounced inspections, responding to police reports and evaluating regulatory submissions and public complaints. The AGCO also conducts ongoing regulatory assurance activities, including regular audits, compliance reviews and mystery shopper visits.

In the horse racing sector, the AGCO ensures compliance with the Rules of Racing by reviewing alleged rule infractions and having Race Officials present to officiate races. The AGCO supports the health and welfare of horses and horse racing participants by monitoring and enforcing the Equine Medication and Drug Control Program and ensuring an official veterinarian is in attendance to supervise live racing.

Partnerships

To support a coordinated approach to compliance activities, the AGCO’s compliance approach places significant emphasis on working with local community partners, including police, fire services, municipal by-law and public health units. In the liquor sector, this work also includes administering the Police Report & Last Drink Programs in partnership with the police.

Mystery Shopper Program

The use of mystery shoppers in the grocery sector continues to be an effective tool to aid in evaluating how grocery stores are performing in preventing youth access to alcohol. Throughout 2022–2023, the AGCO will expand its Mystery Shopper Program to cover all liquor licensees operating within the province.

To adequately assess the sector’s ability to prevent youth access to cannabis products, the AGCO continues to use its Mystery Shopper Program to identify retailers who present an increased risk of permitting youth access. During this fiscal year, the AGCO enhanced the Mystery Shopper Program to support enhanced oversight of cannabis retailers operating close to high schools.

Educational activities

The AGCO proactively provides education to all sectors to increase their understanding of regulatory obligations and improve overall compliance. All new licensees or authorization holders in the liquor and cannabis sectors receive this education. In addition, any licensee or authorization holder can take advantage of these opportunities at any time throughout the life cycle of their licence.

Please note that all information in the following tables has been adjusted to align with the new methodology of categorizing inspections that was implemented in fiscal year 2021–2022.The category “miscellaneous compliance activity” includes but is not limited to compliance activity driven by intelligence or investigation activity, Mystery Shopper Program or criminal charges.

Table 13—Compliance Services inspections—Alcohol

|

|

2020–21 |

2021–22 |

|---|---|---|

|

Inspection Activity |

11,929 |

11,134 |

|

Consultation |

1,431 |

531 |

|

Education |

381 |

527 |

|

Miscellaneous Compliance Activity |

1,003 |

834 |

|

Violations cited |

1,012 |

1,297 |

|

Serious violations escalated for further review |

86 |

116 |

Note: There is a variance between numbers reported in this table for 2020–21 violations cited and serious violations escalated for further review and what was reported in the 2020–2021 Annual Report as a result of changes to data categories.

Table 14—Compliance Services inspections—Lottery retailers

|

|

2020–21 |

2021–22 |

|---|---|---|

|

Inspection Activity |

426 |

166 |

|

Consultation |

13 |

4 |

|

Education |

34 |

0 |

|

Miscellaneous Compliance Activity |

6 |

7 |

|

Violations cited |

48 |

33 |

|

Warnings |

20 |

11 |

Table 15—Compliance Services inspections—Raffles

|

|

2020–21 |

2021–22 |

|---|---|---|

|

Inspection Activity |

4 |

18 |

|

Consultation |

4 |

2 |

|

Education |

1 |

0 |

|

Violations cited |

0 |

3 |

Table 16—Compliance Services inspections—Cannabis

|

|

2020–21 |

2021–22 |

|---|---|---|

|

Inspection Activity |

3,027 |

4,229 |

|

Consultation |

427 |

590 |

|

Education |

1,193 |

685 |

|

Miscellaneous Compliance Activity |

604 |

526 |

|

Violations cited |

131 |

525 |

Table 17—Cannabis private retail inspections

|

|

2020–21 |

2021–22 |

|---|---|---|

|

Systems Assessments in Pre-Opening Inspections |

522 |

929 |

Table 18—Compliance Services inspections—Horse racing

|

|

2020–21 |

2021–22 |

|---|---|---|

|

Inspection Activity |

352 |

419 |

|

Consultation |

17 |

40 |

|

Education |

1 |

6 |

|

Miscellaneous Compliance Activity |

33 |

24 |

|

Violations cited |

32 |

30 |

Table 19—Rulings by Racing Officials

|

Breed |

2020-21 |

2021–22 |

|---|---|---|

|

Thoroughbred |

||

|

Stewards’ Rulings |

109 |

139 |

|

Live Race Dates |

134 |

140 |

|

Standardbred |

||

|

Judges’ Rulings |

313 |

337 |

|

Live Race Dates |

523 |

587 |

|

Quarter Horse |

||

|

Stewards’ Rulings |

22 |

16 |

|

Live Race Dates |

21 |

20 |

Technology Regulation and igaming Compliance Branch activities

Ontario’s public confidence in gaming is supported by the important work performed by the Technology Regulation and Igaming Compliance (TRC) Branch.

In 2021–2022, the TRC Branch successfully navigated a significant transformation to deliver on a new mandate for overseeing all aspects of regulatory compliance of the igaming open market that is to launch in April 2022. This transformation operationalized an innovative compliance framework and created three new units within the branch: Planning and Priority Setting, Independent Test Lab Oversight, and igaming Compliance Assurance.

The role of the Planning and Priority Setting unit is to produce sector-level compliance information, analysis, plans and priorities, providing direction to compliance teams in an evidence-based compliance program.

The role of the Independent Test Lab Oversight unit is to ensure the delivery of high-quality, impartial and independent services that assess and certify gaming technology products for use in Ontario.

The role of the Igaming Compliance Assurance unit is to deliver a full suite of modern and effective compliance assurance activities that address identified compliance priorities, providing reasonable assurance of compliance for regulated internet gaming entities and technology.

The three newly formed units work in concert to create a low-burden, priority-driven compliance program in the internet gaming space.

The TRC Branch ensures the technical integrity of gaming technology by developing minimum technical standards that products must comply with and by testing and providing approvals of games and related gaming systems against those standards. This technology is used throughout the province in all gaming industries and sectors regulated by the AGCO, including casino gaming, charitable and raffle gaming, lotteries and internet gaming.

The TRC Branch is composed of highly qualified and experienced experts. It includes an in- house laboratory (the Gaming Lab) equipped with the same gaming systems used at gaming sites in Ontario.

The Gaming Lab is accredited to the international standard ISO 17025:2017 for testing laboratories, considered the international benchmark for excellence in testing laboratories. This achievement sets the AGCO apart as the only known gaming regulator with an in-house accredited gaming laboratory. This accreditation provides annual third-party assurance of the ongoing quality of the testing performed by the Gaming Lab.

In 2021–2022, the Gaming Lab conducted its annual survey of regulated entities, reaching out to Gaming-Related Suppliers to request their anonymous evaluation and feedback. Twenty-four (24) Gaming-Related Suppliers responded to the survey, with 100 per cent of responses indicating they are either very satisfied or satisfied with the overall service provided by the Gaming Lab. The Gaming Lab will conduct its annual survey in 2022–2023 to gather valuable feedback from regulated Operators to enable it to continue to provide industry-leading services.

|

|

2020–21 |

2021–22 |

|---|---|---|

|

Electronic gaming–related products requested for approval |

1,395 |

2,616 |

|

Low-risk electronic gaming products that were pre-approved |

43 |

51 |

|

Products with regulatory issues discovered by the AGCO that were consequently not approved |

87 |

193 |

|

Average turnaround time for approval |

22 calendar days |

25 calendar days |

Note: There was an increase in requests for approval of gaming-related products in 2021–22 due to industry recovery from the COVID-19 pandemic.

Appeals and arbitration

The AGCO’s Legal Services Division provides legal advice on licensee and registrant compliance within the regulatory framework and represents the Registrar at hearings of appeals before the Licence Appeal Tribunal (LAT), the Horse Racing Appeal Panel (HRAP) and the Divisional Court and the Court of Appeal.

Table 21—Notices of Proposal (NOPs) and Orders of Monetary Penalty (OMPs)—Alcohol

|

|

2020–21 |

2021–22 |

|---|---|---|

|

NOPs • Applications (new, change, transfer) • Disciplinary (suspend and/or add conditions, revoke) • Premises closed (revoke licence) • Other |

61 |

61 |

|

Orders of Monetary Penalty |

9 |

21 |

Table 22—Alcohol-related settlements without a hearing

|

|

2020–21 |

2021–22 |

|---|---|---|

|

Number of settlements agreed to without a hearing (NOPs and OMPs) |

11 |

16 |

Table 23—Notices of Proposed Order (NOPOs) or immediate suspensions—Horse racing

|

|

2020–21 |

2021–22 |

|---|---|---|

|

Notice of Proposed Order to suspend, revoke or immediately suspend a licence |

3 |

5 |

Table 24—Gaming-related settlements without a hearing

|

|

2020–21 |

2021–22 |

|---|---|---|

|

Gaming-related settlements without a hearing |

0 |

2 |

Investigation and Enforcement Activities

Modernization, transformation and integration

The 2021–2022 year saw the implementation of several important initiatives to drive efficiency. The Investigation and Enforcement Bureau (IEB) implemented the Management Inspection Process to ensure processes are incorporated into everyday operations, providing accountability, consistency and reliability.

Pre-screening applicants during the eligibility process is key to supporting the honesty and integrity of licensees, registrants and authorization holders. To support this process, the IEB implemented the Enhanced Cannabis Application Pre-Screening Interview process for Retail Operator and Retail Manager licences to allow for immediate flagging of any criminal associations. In 2021, enhanced Cannabis Application Pre-Screening Interviews identified 80 applicants as problematic or with areas of risk.

In the igaming sector, the IEB implemented Eligibility and Major Investigations pre-screening igaming CEO interview questions to identify any possible risks associated with the AGCO registration of igaming companies.

Anti–money laundering

Anti–money laundering (AML) continues to be a key focus for the IEB. In 2021–2022, the IEB implemented a new enhanced IEB AML investigative strategy that focused Ontario Provincial Police (OPP) resources to attend the casino floor any time they are called for a suspicious cash transaction when the patron is present at the casino. This allows the IEB members to engage and question the patron regarding the source of funds and determine investigative action.

Partnerships are key to the success of our AML programs. This year, the IEB developed and implemented a video to raise awareness of AML investigative analytic processes among stakeholders, including the OLG, the OPP, the AGCO and FINTRAC. These partnerships were further supported by introducing the IEB AML Coordination Model, where dedicated OPP, OLG and AGCO analysts worked closely to query and analyze their respective agency’s data sets to openly share and discuss information and identify individuals and activities that pose AML risks. The IEB also developed and implemented a new joint AML Investigative Process with the OPP

Provincial Asset Forfeiture Unit for identified High Priority Individuals that warrant an AML investigation that will utilize resources effectively.

A data-driven mindset is key to the IEB’s AML approach. An analytical program/dashboard tool has been developed and implemented to help identify and initiate investigations of individuals who pose risks of engaging in money laundering activities. The IEB has reduced a significant number of manual processes by automating the intake of all suspicious transaction reports (STRs) generated at Ontario gaming sites into the established IEB AML analytical program/dashboard tool. This allows the IEB to allocate resources to focus on high-risk gaming areas, and ground decisions and actions against high-priority individuals to determine if criminal investigations and/or regulatory recommendations are warranted.

To support data collection and drive these analytical insights in 2021–2022, the IEB launched a newly developed OPP Report Management System (RMS) STR investigative report and training video. The new report’s drop-down menus and entry fields walk the investigator through the investigation to ensure that nothing is omitted. This data is also trackable, assisting with future analysis of the information collected in the database and statistic collection. Implementing an enhanced IEB Harm Reduction Strategy and training video ensures consistency and that patrons attending casinos in violation of exclusion orders receive addiction assistance when required.

The IEB Intelligence Unit initiated a collaboration between the Biker Enforcement Unit and the RMS Unit to create a streamlined way to search, identify and compare those listed in the Outlaw Motorcycle Gaming databases to those within the AGCO’s regulatory database. This search resulted in over one thousand outlaw motorcycle gaming members’ names that can be compared to all regulated sectors.

Leadership and stewardship

The IEB Anti–Human Trafficking (AHT) Working Group collaborated with the OPP Anti–Human Trafficking Unit, Criminal Intelligence Service Ontario and municipal partners in order to proactively focus on AHT activities. The working group created a 2021 list of AHT police contacts from police jurisdictions across Ontario that house casinos and/or racetracks. The development of this initiative allowed investigators to quickly mobilize a multi-jurisdictional response to locate a wanted material HT witness from Quebec.

The IEB also provided support and subject matter expertise/follow-up to assist GTA municipal police counterparts on illegal gaming venues.

The Cannabis Intelligence Sharing Working Group involving the IEB/AGCO/ Provincial Joint Forces Cannabis Enforcement Team /OCS was implemented to share critical intelligence information, increase linkages to organized crime groups and enhance relationships. In addition, the Legal Cannabis Intelligence Working Group Due Diligence Investigators Network (DDIN) was implemented. The DDIN engaged cannabis regulators across Canada to share critical intelligence and information strategies from involved stakeholders and share linkages to organized crime connections and affiliations.

Table 25—Eligibility investigations

|

|

2020–21 |

2021–22 |

|---|---|---|

|

Gaming and Lottery |

708 |

315 |

|

Cannabis |

478 |

1,037 |

|

Horse Racing |

88 |

122 |

|

Outside Agency Assist Checks |

495 |

381 |

Table 26—Number of IEB investigations

|

|

2020–21 |

2021–22 |

|---|---|---|

|

Internet Gaming |

60 |

126 |

|

Charitable Gaming |

7 |

7 |

|

Cannabis |

0 |

1 |

|

Horse Racing |

0 |

153 |

|

Liquor Licence Holders and Applicants |

140 |

106 |

Table 27—Lottery-related investigations

|

|

2020–21 |

2021–22 |

|---|---|---|

|

Lottery Insider Wins |

49 |

39 |

|

Lottery Suspicious Wins |

92 |

71 |

|

Other Lottery Investigations |

102 |

64 |

Table 28—Occurrences at casinos and slot machine facilities

|

|

2020–21 |

2021–22 |

|---|---|---|

|

Total Investigations in Casinos and Slot Machine facilities |

1,260 |

2,814 |

|

Total Criminal Code Offences |

353 |

117 |

|

Total Non–Criminal Code Related Offences |

280 |

629 |

|

Alleged Cheat-at-Play Instances |

0 |

74 |

|

Cheat-at-Play Charges Laid |

0 |

17 |

Note: This category overlaps with the gaming eligibility investigations in Table 25.

Strategic Direction

Strategic planning goals and themes

The AGCO’s strategic plan outlines the vision and strategic goals for the organization. The AGCO is currently in the third year of its five-year strategic plan.

The AGCO seeks to achieve its vision of being a world-class regulator that is innovative, proactive, inclusive and socially responsible through its three strategic goals: Modern Regulator, Service Excellence and People First.

- Text version of strategic plan

-

Our Strategic Goals Modern Regulator Service Excellence People First Our Key Commitments - Serve the public interest through effective and innovative approaches to regulation in the alcohol, gaming, cannabis and horse racing sectors

- Make evidence-based decisions to regulate in the public interest

- Strengthen our organizational foundation to support the agency’s expanding priorities and business strategies

- Continuously ensure a deep understanding of our stakeholders to anticipate and respond to their evolving needs

- Provide a positive experience through the delivery of services that are clear, timely and that meet the expectations of those we serve

- Champion an inclusive workplace by implementing recommendations from the AGCO’s DI&A strategy to further develop employee’s wellbeing and best serve the people of Ontario

- Develop our talent to empower employees and nurture our internal talent succession pool

Performance measurement framework

The AGCO measures performance and program effectiveness by setting targets, assessing data and evaluating results. Through continuous evaluation and feedback, the AGCO is able to achieve the key objectives identified in the AGCO strategic plan.

The results from these measures, shown in the table below, demonstrate that the AGCO has met or surpassed the majority of agency targets, largely thanks to:

- a continued focus on stakeholder engagement and an enhanced approach to stakeholder education;

- a modern regulatory approach that is risk-based, outcomes-based and compliance- focused;

- a “Future of Work” model that provides the tools and flexibility for a positive employee experience post-COVID;

- the development of a strategy to address diversity, inclusion and accessibility at the AGCO;

- the continuous optimization of iAGCO.

The AGCO is committed to further developing an agency-wide performance strategy. It has created a Business Optimization and Insights Branch to advance multi-year goal setting, link agency efforts to resource planning and develop a robust performance measurement framework to support transparency, accountability and regulatory effectiveness.

Modern Regulator

Key commitments

- Serve the public interest through effective and innovative approaches to regulation in the alcohol, gaming, cannabis and horse racing sectors.

- Make evidence-based decisions to regulate in the public interest.

- Strengthen our organizational foundation to support the agency’s expanding priorities and business strategies.

Performance measure

The AGCO provides user-based services and information through multiple windows and service channels anytime and anywhere.

- Outcome metric: % of users using digital options to transact with the AGCO meets or exceeds target of 85%.

|

|

2020–21 |

2021–22 |

|---|---|---|

|

% of users using digital options to transact with the AGCO |

89.6% |

Overall: 70% Applications: 92% Complaints: 91% Inquiries: 25% |

Projects

Being a Modern Regulator remains a key commitment and shapes how the AGCO regulates and works with its stakeholders. The AGCO is committed to leveraging evidence and effective stakeholder engagement as part of the development and implementation of its regulatory direction. The following corporate projects are based on the AGCO’s commitment to the Modern Regulator strategic goal.

igaming Framework

The upcoming launch of Ontario’s igaming market on April 4, 2022, is a major milestone.

The AGCO developed a regulatory model for this new, competitive market that protects consumers and provides them with choice, reduces red tape and supports legal market growth and provincial returns.

This model reflects the AGCO’s regulatory objectives for igaming while meeting the unique requirements of the igaming open market. It was informed by a series of engagements with industry stakeholders on the Registrar’s Standards for Internet Gaming (Standards) and the eligibility and compliance approaches for igaming. Following the federal government’s legalization of single-event sports betting, the AGCO also undertook stakeholder engagement on the regulatory standards for sports and event betting, which apply to all sports, esports, novelty and betting exchange.

Through the igaming regulatory model, the AGCO undertook several strategic shifts in its operational compliance and eligibility activities to ensure market participants act in accordance with the law, with honesty and integrity, and in the public interest.

The updated risk-based registration model emphasizes applicant ability to meet the Standards and previous experience of applicants, including history in leading jurisdictions. Compliance activities focus on ensuring regulatory objectives are met through innovative, targeted approaches. This includes setting compliance expectations for entry into the market through game and critical system testing and confirmations of full system compliance with the Standards, as well as setting and monitoring priority compliance areas, with targeted monitoring and interventions where appropriate.

The AGCO provided smooth service delivery to igaming customers, including:

- publishing guides on its website to assist prospective igaming Operators and Gaming- Related Suppliers with the registration process (for example, the Internet Gaming Operator Application Guide) and to help them understand compliance requirements when participating in Ontario’s regulated market (for example, the Internet Gaming Go-Live Compliance Guide)

- collaborating with iGaming Ontario on the development and coordination of a robust onboarding process to ensure igaming Operators have met all requirements to enter the market

- implementing a robust customer service model for handling both regulatory and iGO matters, including responding to complaints and inquiries

- making enhancements to the AGCO internet gaming portal, including the creation of a new player support section to provide players with information about the new igaming model and additional resources.

The AGCO also implemented system changes to support the launch of the new igaming market. This included updates to the iAGCO online portal to include igaming applications, processes for complaints and inquiries and ongoing monitoring and managing of compliance activities through regulatory intelligence data.

Auditor General of Ontario: AGCO Value for Money Audit Report

In December 2020, the Auditor General of Ontario released a Value for Money (VFM) Audit Report of the AGCO. The report contained 26 recommendations and proposed 62 action items, along with management responses from the AGCO and the Ministry of the Attorney General; 56 of the action items were assigned to the AGCO for response.

The implementation of the Auditor General of Ontario’s recommendations is one of the AGCO’s five corporate priorities. The AGCO established a dedicated VFM Audit Action Plan Project Team with project leads overseeing working groups to address each recommendation and related action items.

Throughout 2021, the AGCO provided regular quarterly updates to Ontario Internal Audit. The AGCO provided an update outlining the completed and outstanding undertakings for each recommendation to the Standing Committee on Public Accounts in April 2021.

As a result of the recommendations, the AGCO has improved and strengthened regulatory processes within its operations and introduced new functionality into iAGCO. Recommendations have been implemented through robust government partnerships that support the AGCO’s regulatory mandates.

The AGCO remains committed to its action plan and recognizes the value of the Auditor General of Ontario’s recommendations to enhance its effectiveness as a modern regulator. This remains a corporate priority for fiscal year 2022–2023.

Liquor modernization

The Liquor Licence and Control Act, 2019 (LLCA) came into effect on November 29, 2021, marking a major milestone for liquor regulation in Ontario. The new liquor framework under the LLCA enables the AGCO to modernize the way it regulates the sale, service and delivery of liquor and allows for a more flexible approach.

The new liquor framework is designed to reduce burden, facilitate better monitoring and compliance and reflect the changing liquor landscape for the benefit of Ontarians. It includes the introduction of a new liquor licence and permit structure and the transfer of the regulatory authority for some activities from the Liquor Control Board of Ontario (LCBO) to the AGCO.

The Registrar’s Interim Standards and Requirements for Liquor (Interim Standards) came into effect under the LLCA and primarily maintain and consolidate many of the previous requirements. Over the coming years, the AGCO will build on this work to develop a comprehensive outcomes-based regulatory model, consistent with our overall strategic approach for other regulated sectors.

Enhanced social responsibility measures were also introduced with the creation of a new re- certification requirement for licensees relating to the responsible sale, service and delivery training (such as Smart Serve). The AGCO adopted this industry best practice in recognition of the significant modernization of Ontario’s liquor sector and the need for continued commitment to social responsibility and public protection in the liquor sector.

Under the LLCA, several new permissible activities for licence holders took effect, including:

- all licensed grocery stores may offer beer, wine and cider (as applicable) online for curbside pick-up at the store, as permitted under their licence;

- licensed grocery stores are permitted to display non-liquor products, excluding energy drinks and products that promote immoderate consumption, within the contiguous aisles where liquor products (that is, beer, cider, wine) are displayed;

- Liquor Sales Licence holders are permitted to infuse liquor to create drinks or change the flavour of liquor through practices such as barrel aging, as long as the customer is informed;

- a new temporary extension endorsement allows manufacturers with a retail store at their production site to sell liquor products at industry promotional events, in addition to farmers’ markets;

- the removal of alcohol by volume (ABV) limits that wine and brew pubs were previously subject to (previously, wine pubs could not sell wine with greater than 14% ABV and brew pubs could not sell beer with greater than 6.5% ABV);

- ferment on premise facilities are permitted to combine multiple customers’ ingredients, allowing innovative practices such as barrel aging;

- manufacturers are permitted to deliver the liquor products of other licensed manufacturers that have an on-site retail store (a new delivery endorsement enables this activity).

Equine welfare

The AGCO continues to be an industry leader in promoting equine health and safety. In fiscal year 2021–2022, reviews of equine fatalities were enhanced by conducting more toxicological analysis looking for both therapeutic medication and non-therapeutic performance-enhancing substances. Additionally, trainer medication records and treating veterinarian medical records were reviewed with greater scrutiny to improve their quality.

Acknowledging the critical role they play in preventing equine fatalities, AGCO Veterinary Services started meeting with trainers and their veterinarians to share information. These measures are in keeping with the AGCO’s strategic goal to be a Modern Regulator and make evidence-based decisions to regulate in the public interest.